Difference between market value and book value of equity

Market Value vs. Book Value WACC

We will discuss the difference between book value WACC and market value weights and why market value weights are preferred over book value weights. It is assumed that the primary purpose of WACC is to evaluate new projects. The weights can be historical or marginal and further historical weights can have either book values or market values of capital components.

Therefore, three possible types of weights are discussed below with the help of following table of calculations:. These are the proportion of capital in which the fresh capital for the new project is raised. In the table below, we can notice that funds are raised for the new project in the ratio of 1: Preference and these proportion are used to calculate the WACC.

We can observe that the WACC is the lowest compared to other two weighting approaches and it is also visible that the reason is the higher proportion of debt in the capital structure. These are the proportion of actual existing capital structure in terms of book value or market value. Historic weights assume that the firm will finance its future projects in the existing capital structure and it is the optimum structure.

We have concluded historical weights between marginal vs.

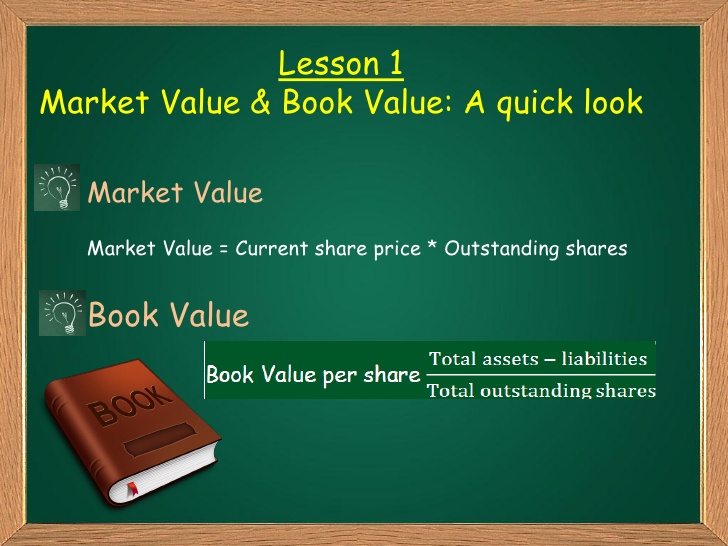

What's the difference between book and market value?

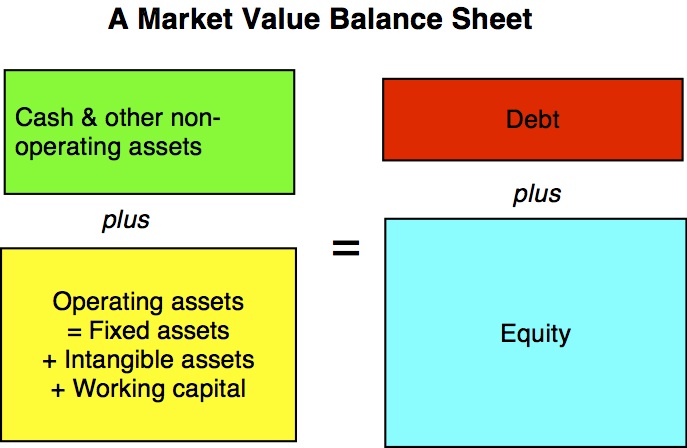

Book Value WACC is calculated using book value weights whereas the Market Value WACC is calculated using the market value of the sources of capital. Why the market value weights are preferred over book values weights:. The book value weights are readily available from balance sheet for all types of firms and are very simple to calculate.

What's the difference between book and market value?

On the other hand, for Market Value weights, the market values have to be determined and it is a real difficult task to acquire accurate data for the same especially the value of equity when the entity is not listed. Still Market Value WACC is considered appropriate by analysts because an investor would demand market required rate of return on the market value of the capital and not the book value of the capital.

Market Value Versus Book Value | Investopedia

Let us see how a rational investor will behave. Why 30 dollar because the investment by him is 30 and not 10 or The existing investor will exit from the investment considering it an overpriced stock and invest in securities which are underpriced or appropriately priced by the market. The market value weights are appropriate compared to book value weights. Hence, historical market value weights should be used for calculation of WACC out of the three options — marginal weights, historical book value weights, and historical market value weights.

He is passionate about keeping and making things simple and easy. Running this blog since and trying to explain "Financial Management Concepts in Layman's Terms". Notify me of follow-up comments by email.

Notify me of new posts by email. Enter your email address to subscribe to this blog and receive notifications of new posts by email. About Us Site Map Contact Us.

Sources of Finance Working Capital Financing Corporate Finance Financial Management Investment Decisions Financial Analysis Financial Leverage Mergers and Acquisitions Dividend Decisions Financial Accounting Corporate Restructuring International Financial Management Derivatives Costing Terms Budgeting Zero Based Budgeting Financial Management Sources of Finance Working Capital Financing Financial Analysis Investment Decisions Dividend Decisions Financial Accounting Financial Leverage International Financial Management Mergers and Acquisitions Costing Terms Budgeting Zero Based Budgeting.

Book Value WACC if window. Share it in comments below. Leave a Reply Cancel reply Notify me of follow-up comments by email. Subscribe to Blog via Email Enter your email address to subscribe to this blog and receive notifications of new posts by email. Find us on Facebook.

Use of this feed is for personal non-commercial use only. If you are not reading this article in your feed reader, then the site is guilty of copyright infringement.

Send to Email Address Your Name Your Email Address Cancel Post was not sent - check your email addresses! Sorry, your blog cannot share posts by email.