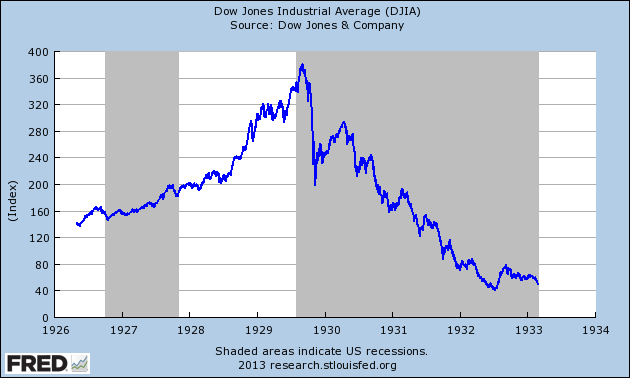

1933 stock market returns by year

The crash of was a blip. The depths of were like a nuclear bomb going off and leaving nothing but wasteland. No rational human being could have possibly acquired ownership stakes on those terms and thought to do well, with the typical issue trading at 30x earnings, representing a starting earnings yield of roughly half the yield that could have been attained by acquiring a long-term United States Treasury bond at the time.

It was the bursting of this bubble that caused stocks to become an absolute steal, but most people were starving to death, waiting in breadlines. General Electric — it was perfectly rational.

Chart History of Stock Market

The market overreacted on the other side, getting as cheap as it had been expensive. Still, no true investor would have been caught holding boring blue chip Chase National Bank at 62x earnings in ! Sixty two times earnings. That is an earnings yield of 1. And despite trading at more than twice what the overvalued stock market as a whole was, it had a lower return on equity! It was such a bizarre time. People lost their minds on the upside, and gave up all hope on the downside. Anyone with money during these dark days got very rich.

Imagine buying into General Mills at accounting liquidation value and getting paid 8. Remember this lesson, too: It was from these depths in , that stocks went on an amazing 4 to 5 year streak, skyrocketing.

No one cared, though. They had been too burned by wanton speculation and borrowed money. Stocks are at crazy levels. Most of the banking, consumer, manufacturing, utilities stocks are around 25 times earnings. With the banking stocks rising rapidly. Most of your friends are pouring into the stock market, piling on margins and laughing to the bank.

You were invited to lavish dinners by your mates, but you still had to pay for it. Your neighbour just bought the latest Cadilac Fleetwood, and your friends are discarding their Chevrolet, upgrading to the latest model of Buick.

Stock tips are around. Stories of how Baruch is cornering the market with its latest takeover of the smaller banks. As the Dow Jones Industrial Index continue announcing record breaking new highs, banking stocks reached 33 times current year earnings, you begin wondering whether it is time to sell off your bank stocks and buy some oil and steel stocks instead. The steel stocks were highly leveraged ever since JP Morgan bought them over.

Dividends were at 3. Perhaps you should have bought their bonds instead. Everything is just so expensive. Standard Oil seems a lot more cheaper, maybe you should sell the utilities and buy the oil stocks instead. But there is this constanly falling oil price. Simply too many uncertainties. Day and night you seek out information on the oil stocks to give you a more informed view on the future oil.

Rail road stocks looks alright, but not great. Dividend income is a constant. The latest bond offering by one of the rails were undersubscribed. There does not seem to be too many great choices. You worked on seeking the most efficient oil producer, selling all your banking stocks, moving more of your funds into tobacco stocks and other staples.

You felt that enough is enough. You were getting sneers from your peers and family for selling away your banking stocks. The banking stocks were making new highs nearly every week. No matter how you explained that it was a rational decision, you were still getting doubts.

He said its going to split from to 30 soon, and when it split to 30, it will rise very quckly back to That is a fact. They had kept on increasing. Never before you feel so stressed up by a world laughing at you. Self-doubt begins creeping in. You began questioning yourself. Is it really different this time? You wonder whether you can continue remain sane.

Maybe you should buy gold. But no dividends, no income. What if the world will go on for the next 10 years at such high valuation instead?

What if this is the new norm? And they looked at you in puzzlement. Times had never been better than now, and you wanted us to sell. But what bonds to buy? Bond prices flutuates too. What if bond prices fall? What if interest rates rises? Some bonds are selling above par, and some below. Bond trading commision is at 0. What should I buy Joshua? What about Fixed Deposit in banks instead, Joshua? Stock prices were falling. You were receiving calls from your friends and extended family for private loans for them to cover their margin gaps caused by their recent losses.

They were crying to you. All I can do now is to hope that the markets recovers a bit, and maybe I can breakeven. Joshua, please lend me some money so that I can buy more. The market can only recover from this low. This must be the bottom. You were getting dire calls from your friends and extended family and relatives.

Business are doing poorly. Many of them unemployed. They had great losses and tremendous debt from their margin calls. Even more people are asking you and your family to lend money to them to survive and live.

Can you just close your eyes and say no? Alright Joshua, I think we walked enough back in time. I have slotted some questions in as you can tell. And maybe these questions can be discussed and your viewpoint can be shared in multiple posts. And also, maybe you can discuss what you would have done instead, allocating capital wise, family wise, perception wise, communication wise, emotionally control.

Every seller has a buyer. I have tried to explain to people why it rarely makes since to swear off home ownership.

They will probably never understand. I worked out for someone once that they would end up paying several million dollars more than me in their lifetime, even if I had an incredibly high cost of normal maintenance, but they still felt it was cheaper to rent.

Financial myopia hurts when it afflicts people we care about. You just brought up one my favorite truths in the stock market: For every share sold, there MUST be another buyer on the other side of that transaction! There are no net sales or net buys. Every transaction is balanced between a buyer and a seller.

That price gets shifted as one side outweighs the other, but the overall transaction cannot take place without two sides to the table.

I am not so much interested in making money off the mistakes of others as I am in owning assets and profiting from their underlying contribution to the economy. Not only does this leave me in the safer place of always being able to resort to the intrinsic value utility of the cash it generates, it is also morally superior because you deserve every dollar you earn. By and , the economy itself was good, the valuations of public securities were bad. I would have taken my money directly to the assets themselves by seeking out ownership of things that produced the money directly, like buying oil wells since, as you pointed out the prices had already dropped.

During the Great Depression, one of my great grandfathers owned the entire side of the highway in a town in Missouri, where he had a gas station. If friends and family want my opinion on financial matters, they have me control the money.

The reason is simple: If I am incorrect, they will blame me and build up resentment. There is no positive contribution to utility for me here, but plenty of costs so I never allow myself to enter a situation where that can happen.

There is no profit there, which was clear by the fact that the companies had only raised dividends once in a decade or two.

A steel mill at 12x normal earnings is as bad as a bank at 30x normal earnings. Now, the oil stocks … the oil stocks would have interested me.

Years of Stock Market Returns

So would the tobacco stocks. It just means people have lost their minds more than you expected. It would not cost me a moment of sleep or cause any self-doubt. A majority of certain populations would take their newborn infants and sacrifice them to imaginary wizards in the sky for a good harvest.

A majority of certain populations would enslave other races, beat them, rape them, and teach their kids to do the same. Independent thinking is hit on as a theme in this site so often because it is your highest moral responsibility. That extends to your finances. Never going to happen. You never throw good money after bad.

This is a no brainer. It depends on the circumstances. I will be almost unlimitedly generous with my knowledge, and help catch them when they fall, but if I do the work, it will never really be your accomplishment. More money never solves it.

It kicks the can down the road. That is not even remotely a comparable situation, in my mind. I think through this last night and was reading more from this site. I did noticed that maybe I could have own a local business instead which will still generate reasonable return.

And also, I forgot that you can just have held cash instead. Cash is a call option on every other classes of assets. I guess it is a must to be an operator. This is really something to think about. In my mind, being an operator takes a lot more commitment than just being a shareholder.

If my funds are small, I might not be able to buy over an existing business and have a management team run it. They would have to go into business themselves. Something to think about — very seriously. Joshua, thanks for sharing your thoughts. Your the first investment pro I notice with good principles. Most are dominated by an excessive compulsive desire called greed and a high level of selfishness. This is why I should point out that I am so adamant that a significant portion of your cash earnings power should come from assets outside of the securities markets.

You could have taken that cash, thrown darts at the stock listings in the newspaper, and become very rich over the subsequent 25 years. You must have an outside cash generator or a wholly owned asset that produces money — in cash — that you control.

Of course, owning inversely correlated assets, such as the gold shares, would have allowed one to acquire distressed firms inexpensively as well. To help offset bandwidth costs and other expenses of running a successful blog, the site now features affiliate referrals that convert words into affiliate links that pay us for the transaction.

For more information, or if you run a website and want to sign up yourself, visit VigLink. Skip to content Search: Rss YouTube Pinterest Twitter. Thoughts on Business, Politics, and Life from a Private Investor. A Look at Some Major Stocks During the Bottom of the Stock Market Crash.

Stock Market By Joshua Kennon March 12, 9 Comments. The Two Secrets to Living a Happy Life Next Next post: Food Stocks and the Great Depression. The bond yield and prices pdf document has been very useful. Thanks for sharing it out.

What a wonderful comment! You made my day with this. Reading through it, here were my thoughts as they occurred to me: I would not lend them money.

A Look at Some Major Stocks During the Bottom of the Stock Market Crash

I enjoy your thoughts Joshua. Letter from a Birmingham Jail by Dr. Martin Luther King Jr. We Bought a New Car. Epiphany Moments that Change Your Worldview November 20, Since , Joshua Kennon has been the Investing for Beginners Expert at About. In the going-on two decades since he first published for the network, he has built up a body of work of more than 1, articles, essays, and lessons that are available to read for free, covering everything from how to analyze a balance sheet to strategies for portfolio risk reduction.

More formally structured than the content on this personal blog, they are a fantastic introduction to the basics of wealth building and asset management for new and experienced investors alike. This is a personal blog intended for academic, educational, and social engagement among members of a like-minded community. Nothing on this site is intended or should be construed as investment advice, financial advice, tax advice, or legal advice. You are solely responsible for your own financial decisions, agree that you will seek the advice of your own qualified professional advisors, agree that you, and you alone, are solely responsible for any financial consequences or losses as a result of your actions, and use of the site constitutes your agreement that you will not rely upon any information found on the site, including the comments.

All text, images, and resources are provided on an "as is" basis with no guarantee of accuracy and with no obligation to update or correct information. For more information, read the terms and conditions.