Calendar effects in stock market returns

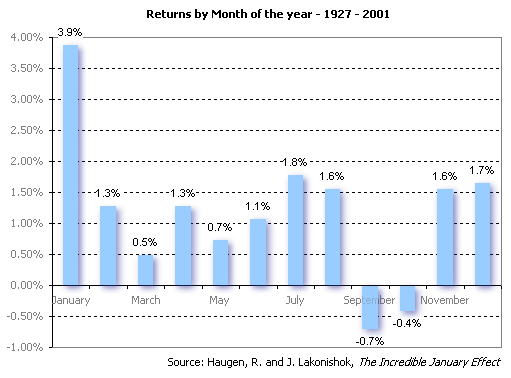

But, the calendar effects phenomenon made a different return in each single day in a week or month. This is an abnormal return which can affect investor in deciding investment strategy, portfolio selection, and profit management.

This study investigates the day of the week effect, more precisely the Monday effect and the January effect on the Stock Exchange of Mauritius SEM in order to get the information whether these anomalies exist or not. Linear regression model, GARCH and EGARCH models are used to answer our objective. The result shows that Monday effect is nonexistent in SEM. However, we find a significant positive January effect at market level.

This study also concludes that volatility shocks are persistent in both daily and monthly returns and moreover, reports the presence of leverage effect in the daily stock returns. Evidence from the Stock Exchange of Mauritius April 23, Subscribe to this fee journal for more curated articles on this topic.

An Anatomy of Calendar Effects. By Laurens Swinkels and Pim Van Vliet. Testing the Significance of Calendar Effects.

Calendar Effects on Stock Market Returns: Evidence from the Stock Exchange of Mauritius by D. Sewraj, Boopen Seetanah, V. Sannasee, U. Soobadur :: SSRN

By Peter Hansen , Asger Lunde , An Analysis of the Day of the Week Effect and the January Effect on the Stock Exchange of Mauritius. Are Calendar Anomalies Still Alive?: Evidence from Istanbul Stock Exchange. A Survey of Calendar Effect in BSE-SENSEX.

Calendar effect - Wikipedia

By Mark Haug and Mark Hirschey. The Month-of-the-Year Effect in the Australian Stock Market: An Analysis of the Market, Industry and Firm Size Impacts. By George Marrett and Andrew Worthington.

Evidence from GARCH Models in Fifty Five Stock Markets. Cookies are used by this site.

To decline or learn more, visit our Cookies page. This page was processed by apollo7 in 0. Your Account User Home Personal Info Affiliations Subscriptions My Papers My Briefcase Sign out.

Download this Paper Open PDF in Browser Share: Using the URL or DOI link below will ensure access to this page indefinitely. Sannasee RMIT University U. Boopen Seetanah Contact Author University of Mauritius email Reduit, Mauritius. Sannasee RMIT University La Trobe Street Melbourne, Australia.

Download this Paper Open PDF in Browser.

Calendar Effects

Related eJournals Capital Markets: Market Efficiency eJournal Follow. Market Efficiency eJournal Subscribe to this fee journal for more curated articles on this topic FOLLOWERS. Finance eJournal Subscribe to this fee journal for more curated articles on this topic FOLLOWERS.

Recommended Papers An Anatomy of Calendar Effects By Laurens Swinkels and Pim Van Vliet Testing the Significance of Calendar Effects By Peter Hansen , Asger Lunde , An Analysis of the Day of the Week Effect and the January Effect on the Stock Exchange of Mauritius By S. Bundoo Are Calendar Anomalies Still Alive?: Evidence from Istanbul Stock Exchange By Recep Bildik Stock Market Anomalies: A Survey of Calendar Effect in BSE-SENSEX By Abhijeet Chandra The January Effect By Mark Haug and Mark Hirschey The Month-of-the-Year Effect in the Australian Stock Market: An Analysis of the Market, Industry and Firm Size Impacts By George Marrett and Andrew Worthington The Month-of-The-Year Effect: Evidence from GARCH Models in Fifty Five Stock Markets By Eleftherios Giovanis.

Eastern, Monday - Friday. Submit a Paper Section Text Only Pages. Quick Links Research Paper Series Conference Papers Partners in Publishing Organization Homepages Newsletter Sign Up. Rankings Top Papers Top Authors Top Organizations. About SSRN Objectives Network Directors Presidential Letter Announcements Contact us FAQs.

Copyright Terms and Conditions Privacy Policy.