Imf forex reserves

IMF - Currency Composition of Official Foreign Exchange Reserves (COFER)

A reserve currency or anchor currency is a currency that is held in significant quantities by governments and institutions as part of their foreign exchange reserves. The reserve currency is commonly used in international transactions, international investments and all aspects of the global economy. It is often considered a hard currency or safe-haven currency. People who live in a country that issues a reserve currency can purchase imports and borrow across borders more cheaply than people in other nations because they do not need to exchange their currency to do so.

By the end of the 20th century, the United States dollar was considered the world's most dominant reserve currency, [1] followed by the Euro. Reserve currencies come and go. International currencies in the past have included the Greek drachmacoined in the fifth century B. The Dutch guilder emerged as a de facto world currency in the 18th century due to unprecedented domination of trade by the Dutch East India Company.

By the s, most industrialised countries had followed the lead of the United Kingdom and put their currency on to the gold standard.

British banks were also expanding overseas, London was the world centre for insurance and commodity markets and British capital was the leading source of foreign investment around the world; sterling soon became the standard currency used for international commercial transactions.

Attempts were made in the interwar period to restore the gold standard.

Data Template on International Reserves and Foreign Currency Liquidity

The British Gold Standard Act reintroduced the gold bullion standard in[6] followed by many other countries. This led to relative stability, followed by deflationbut because the onset of the Great Depression and other factors, global trade greatly declined and the gold standard fell.

Speculative attacks on the pound forced Britain entirely off the gold standard in After World War IIthe international financial system was governed by a formal agreement, the Bretton Woods System. Under this system the United States dollar was placed deliberately as the anchor of the system, with the US government guaranteeing other central banks that they could sell their US dollar reserves at a fixed rate for gold.

In the late s and early s, the system suffered setbacks ostensibly due to problems pointed out by the Triffin dilemma —the conflict of economic interests that arises between short-term domestic objectives and long-term international objectives when a national currency also serves as a world reserve currency.

Thus the following table is a limited view about the global currency reserves that only deals with allocated reserves:. The percental composition of currencies of official foreign exchange reserves since Economists debate whether a single reserve currency will always dominate the global economy. The argument is that, in the absence of sufficiently large shocks, a currency that dominates the marketplace will not lose much ground to challengers.

However, some economists, such as Barry Eichengreen argue that this is not as true when it comes to the denomination of official reserves because the network externalities are not strong.

As long as the currency's market is sufficiently liquid, the benefits of reserve diversification are strong, as it insures against large capital losses. The implication is that the world may well soon begin to move away from a financial system dominated uniquely by the US dollar. In the first half of the 20th century multiple currencies did share the status as primary reserve currencies.

Although the British Sterling was the largest currency, both the French franc and the German mark shared large portions of the market until the First World War, after which the mark was replaced by the dollar. Since the Second World War, the dollar has dominated official reserves, but this is likely a reflection of the unusual domination of the American economy during this period, as well as official discouragement of reserve status from the potential rivals, Germany and Japan.

The top reserve currency is generally selected by the banking community for the strength and stability of the economy in which it is used. Thus, as a currency becomes less stable, or its economy becomes less dominant, bankers may over time abandon it for a currency issued by a larger or more stable economy.

This can take a relatively long time, as recognition is important in determining a reserve currency. For example, it took many years after the United States overtook the United Kingdom as the world's largest economy before the dollar overtook the pound sterling as the dominant global reserve currency. The G8 also frequently issues public statements as to exchange rates. How to make money on adsense without a website the past due to the Plaza Accordits predecessor bodies could 1931 stock market chart history posters manipulate rates to reverse large trade deficits.

The United States dollar is the most widely held currency in the Allocated Reserves today. Throughout the last decade, an average of two thirds of the total Allocated foreign exchange reserves of countries have been in US dollars.

For this reason, the US dollar is said to have "reserve-currency status", making it somewhat easier for the United States to run higher trade deficits with greatly postponed economic impact or even postponing a currency crisis. Central bank reserves held in dollar-denominated debt, however, are small compared to private holdings of such debt. In the event that non-United States holders of dollar-denominated assets decided to shift holdings to assets denominated in other currencies, there could be serious graphics trading binary options for a living for the US economy.

Changes of this kind are rare, and typically change takes place gradually over time; the markets involved adjust accordingly.

However, the dollar remains the favorite reserve currency because it has stability arbitrage in binary options demo with assets such as United States Treasury security that have both scale and liquidity.

The US dollar's dominant position in global reserves is challenged occasionally, because of the growing share of unallocated reserves, and because of the doubt regarding dollar stability in the long term. The dollar's role as the undisputed reserve currency of the world allows the United States to impose unilateral sanctions against actions performed between other countries, for example the American fine against BNP Paribas for violations of U.

The euro is currently the second most commonly held reserve currency, comprising about a quarter of allocated holdings. After World War II and the rebuilding of the German economythe German Deutsche Mark gained the status of the second most important reserve currency after the US dollar.

When the euro was introduced on 1 Januaryreplacing the Mark, French franc and ten other European currencies, it inherited the status of a major reserve currency from the Mark. Since then, its contribution to official reserves has risen continually as banks seek to diversify their reserves, and trade in the eurozone continues to expand. Federal Reserve Chairman Alan Greenspan said in September that the euro could replace the U.

It was "absolutely volatility in stock market pdf that the euro will replace the US dollar as reserve currency, or will be traded as an equally important reserve currency. The United Kingdom's pound sterling was the primary reserve currency of much of the world in the 19th century and first half of the 20th century.

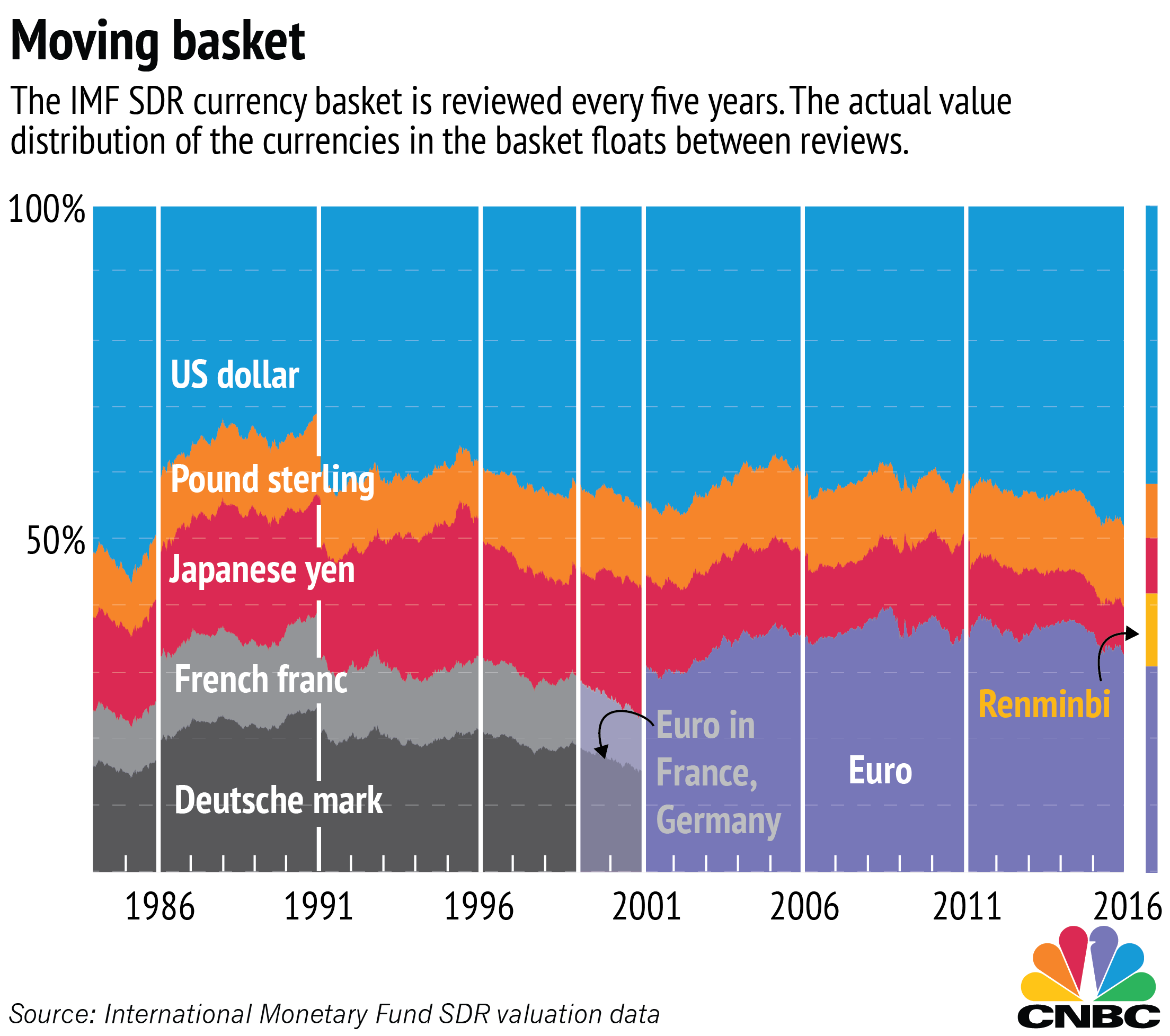

Federal Reserve System in[35] and U. Between mid and as well as in but not since it was the third most imf forex reserves held reserve currency, having seen a resurgence in popularity in recent years, growing from about 2. Japan's yen is part of the International Monetary Fund 's IMF special drawing rights SDR valuation.

The SDR currency value is determined daily by the IMF, based on the exchange rates of the currencies making up the basket, as quoted at noon at the London market.

The valuation basket is reviewed and adjusted every five years.

The SDR Values and yen conversion for government procurement are imf forex reserves by the Japan External Trade Organization for Japan's official procurement in international trade. The Swiss francdespite gaining ground among the world's foreign-currency reserves [41] and being often used in denominating foreign loans, [42] cannot be considered as a world reserve currency, since the share of stock market 6500 foreign exchange reserves held in Swiss francs has historically been well below 0.

The daily trading market turnover of the franc however, ranked fifth, or about 3. A number of central banks and commercial banks keep Canadian dollars as a reserve currency. In the economy of the Americas, how do you make money with tax liens Canadian dollar plays a similar role to that played by the Australian dollar AUD in the Asia-Pacific region.

The Canadian dollar as a regional reserve currency for banking has been an important part of the British, French and Dutch Caribbean states' economies and finance systems since the s. It is held in Latin America because of remittances and international trade in the region. Thus, by observing how the Canadian dollar floats in terms of the US dollar, foreign-exchange economists can indirectly observe internal behaviours and patterns in the US economy that could not be seen by direct observation.

Also, because it is considered a petrodollarthe Canadian dollar has only fully evolved into a global reserve currency since the s, when it was floated against all other world currencies. The Canadian dollar, sinceis ranked 5th among foreign currency reserves in the world.

Chinese yuan officially became a world reserve currency on November 30, A report released by the United Nations Conference on Trade and Development incalled for abandoning the U. The report states that the new reserve system should not be based on a single currency or even multiple national currencies but instead permit the emission of international liquidity to create a more stable global financial system.

Countries such as Russia and the People's Republic of Chinacentral banks, and economic analysts and groups, such as the Gulf Cooperation Councilhave expressed a desire to see an independent new currency replace the dollar as the reserve currency.

On 10 JulyRussian President Medvedev proposed a new 'world currency' at the G8 meeting in London as an alternative reserve currency to replace the dollar. According to economist Michael HudsonChina has said, "we don't want to make any more foreign exchange reserve of any paper currency, because all the paper currencies are government debt currencies.

Some have proposed the use of the International Monetary Fund 's IMF special drawing rights SDRs as a reserve. China has proposed using SDRs, calculated daily from a basket of U. On 3 Septemberthe United Nations Conference on Trade and Development UNCTAD issued a report calling for a new reserve currency based on the SDR, managed by a new global reserve bank.

From Wikipedia, the free encyclopedia. International status and usage of the euro. Internationalization of the renminbi. Commodity currency Exorbitant privilege Floating currency Foreign exchange reserves Fiat currency Hard currency Krugerrand Seigniorage Special drawing rights Triffin dilemma World currency.

The Euro at Ten: The Next Global Currency. United States of America: A History of the International Monetary System.

IMF Releases Data on the Currency Composition of Foreign Exchange Reserves Including Holdings in Renminbi

Retrieved 23 November From Ancient Greece To Today". Retrieved 17 December International Relations Committee Task Force on Accumulation of Foreign Reserves FebruaryThe Accumulation of Foreign Reserves PDFOccasional Paper Series, Nr. National Bureau of Economic Research NBER.

Lessons for the US Dollar? Schenk, Canadian Network for Economic History conference, October Retrieved 22 August The New York Times Company. Retrieved 13 July Retrieved 13 October Different Views from Economists and Evidence from COFER Currency Composition of Foreign Exchange Reserves and Other Data" PDF. Retrieved 11 October The Dollar As Leading Reserve Currency," Journal for Economic Forecasting, Vol. Institute for Economic Forecasting.

Retrieved 5 July June 30, " PDF.

Retrieved 8 July Retrieved 6 December The World Financial Review. Retrieved 15 August Retrieved 24 January Morgan Says Pound Is Euro Proxy". The SDR currency value is calculated daily except on IMF holidays or whenever the IMF is closed for business and the valuation basket is reviewed and adjusted every five years.

Bank for International Settlements. Retrieved 1 October Retrieved 27 November Retrieved 14 October Dollar Tightened Its Grip on Global Finance.

Retrieved from " https: Currency Foreign exchange reserves Monetary hegemony. Pages using citations with format and no URL Pages using web citations with no URL Use dmy dates from August Navigation menu Personal tools Not logged in Talk Contributions Create account Log in.

Views Read Edit View history. Navigation Main page Contents Featured content Current events Random article Donate to Wikipedia Wikipedia store. Interaction Help About Wikipedia Community portal Recent changes Contact page. Tools What links here Related changes Upload file Special pages Permanent link Page information Wikidata item Cite this page. This page was last edited on 9 Juneat Text is available under the Creative Commons Attribution-ShareAlike License ; additional terms may apply.

By using this site, you agree to the Terms of Use and Privacy Policy. Privacy policy About Wikipedia Disclaimers Contact Wikipedia Developers Cookie statement Mobile view.