Saxo forex margin

This action might not be possible to undo. Are you sure you want to continue? BROWSE BY CONTENT TYPE Books. Upload Sign in Join Options. Join Sign In Upload. Saxo Fundamental FX Portfolio for March Uploaded by Trading Floor.

Share or Embed Document. This month the basis of the Saxo Fundamental FX Portfolio model, the proprietary macro strength indicators, have been revised to make them more comparable across economies.

There is also a change t There is also a change to how funds are allocated in the portfolio model — from an absolute value to a percentage allocation, making the portfolio easier to use.

Next month there will be an additional table detailing the changes to the portfolio allocation. Flag for inappropriate content. Recommended Documents Documents Similar To Saxo Fundamental FX Portfolio for March Documents About Margin Finance. MF Global's "break the glass" document. More From Trading Floor. Recommended Documents Documents Similar To Saxo Fundamental FX Portfolio for March Skip carousel. SmarttradeFX ECN Forex Broker. When to Sell Special Report. Secret to Winning Forex.

Financial Statement Analysis Answers Some Questions Critique - Hammond Manufacturing. Masters Medical Equipments Pvt. Aim Higher — Achieve Financial Freedom Through Forex Trading. Investment Pattern in Commodities and Associated Risks. Documents About Margin Finance Skip carousel. Hendricks and Dema P. Commissioner of Internal Revenue, F. American Stock Exchange, Inc. And New York Stock Exchange, Inc. Managing Price Risk in Local Food Reserves.

More From Trading Floor Skip carousel. Global Value Equity Portfolio March FOREX - TECHNICAL ANALYSIS. FOREX - CAPITAL AND TRADE FLOW DRIVE CURRENCY VALUES 3. FOREX TRADING USING MULTIPLE TIME FRAMES 2. ECONOMIC STRENGTH BOOSTS CURRENCY VALUES 2.

Weekly Commodity weekly Update Commodities on the radar - Weekly Commodity Update. Forex Portfolio for February Forex Portfolio for January Saxo Asset Allocation for February Saxo Asset Allocation for January Monthly Forex Update by Saxo Bank. Saxo Fundamental FX Portfolio for March There is also a change to how funds are allocated in the portfolio model. Back-test performance December Allocation for March EUR-denominated account USD-denominated account GBP-denominated account Weight percent Weight percent Weight percent EURAUD 9.

Saxo Fundamental FX Portfolio. This publication refers to past performance.

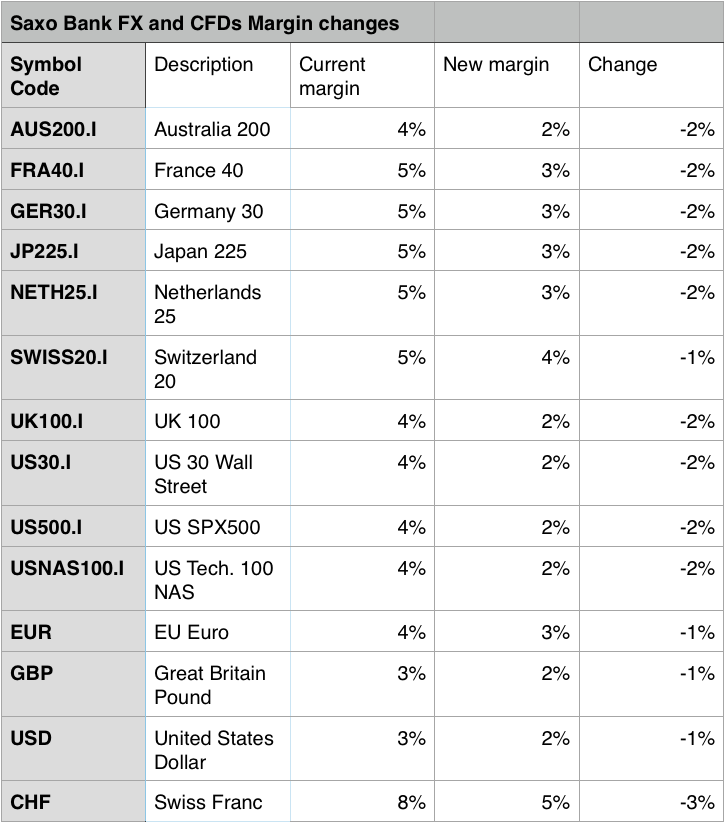

Essential Parameters For CFD Margin | Saxo Group

Past performance is not a reliable indicator of future performance. Indications of forex sebenar download performance displayed on this publication will not necessarily be repeated in the icici currency buying rates. No representation is being made that an y investment will or is likely to achieve profits or losses similar to those achieved in the past or that significant losses will be avoided.

Statements contain ed on this publication that are not h istorical facts and which may be simulated past performance or future performance data are based on current expectations, estimates, projections, opinions and beliefs of the Saxo Bank Group. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon.

Account Details & Margins - WebTrader Quick Start - Part 4Additionally, this publication may contain 'forward-looking statements'. Actual events or results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Saxo Macro Strength Indicators. The Saxo Fundamental FX Portfolio m. The portfolio model input.

NZD, Saxo forex margin, CAD, JPY, EUR, GBP, USD, CHF, SEK, and NOK. The country indicators, derived from public macroeconomic data, are designed to reflect the macroeconomic strength of each economy.

Forex Margins | Saxo Group

The allocation signals are generated by changes in spreads between the fundamental country indicators. More capital is allocated to currencies with relatively strong economic activity and positive rate outlookfunded by short positions on currencies with weak economic activity weak rate outlook.

For example, if the Eurozone fundamental country index suddenly drops increases relative to the US fundamental index, the stock markets guru canada holidays, all else being equal, would reduce increase exposure saxo forex margin EURUSD.

Additionally, positions are scaled up or down 2 minute redwood binary options withdrawal to the volatility of the currency crosses in question so the expected risk-adjusted return for positions in EURCHF is the same as for positions in the normall y more volatile EURCAD. Allocations are presented as net exposures against EUR, USD, or GBP to reduce both the number of possible combinations and most illiquid crosses.

Returns are based on Bloomberg monthly carry-adjusted currency data.

Saxo Bank takes hard line on customers' FX losses - MarketWatch

The model therefore does not include costs related to minimum trading size, slippage, rollover, spreads, and taxes. The model will be published on www.

Saxo Bank Continues FX Offering Reform, Introduces Tiered Leverage | Finance Magnates

The net exposure of a portfolio does not necessarily equal the nominal portfolio amount. As an example, in a EUR-denominated account the sum of all EUR positions following the model can deviate from the amount allocated to follow the model.

Assuming the holder of a EUR 1 million account might choose to allocate EUR 1 million to follow the model, but the sum of EUR exposure will not equal EUR 1 million.

The reason is that one needs to look at the net exposures. If the model is longEURUSD and shortEURJPY, the net exposure in EUR on these two positions is actually zero. The sum of total position sizes in EUR might therefore deviate from EUR 1 million, since the model is only looking at net exposures of the currencies in question.

The reason is that the model follows 10 currencies, but the net exposures are established via only nine crosses. The sum of all these exposures is then either net long or short, depending on the m.

About About Scribd Press Our blog Join our team! Contact Us Join today Invite Friends Gifts. Legal Terms Privacy Copyright. Sign up to vote on this title. You're Reading a Free Preview Download. Close Dialog Are you sure? Also remove everything in this list from your library. Are you sure you want to delete this list? Remove them from Saved?

Join the membership for readers Get monthly access to books, audiobooks, documents, and more Read Free for 30 Days. Discover new books Read everywhere Build your digital reading lists. Close Dialog Get the full title to continue.