Arbitrage price call option

Put-Call Parity And Arbitrage Opportunity

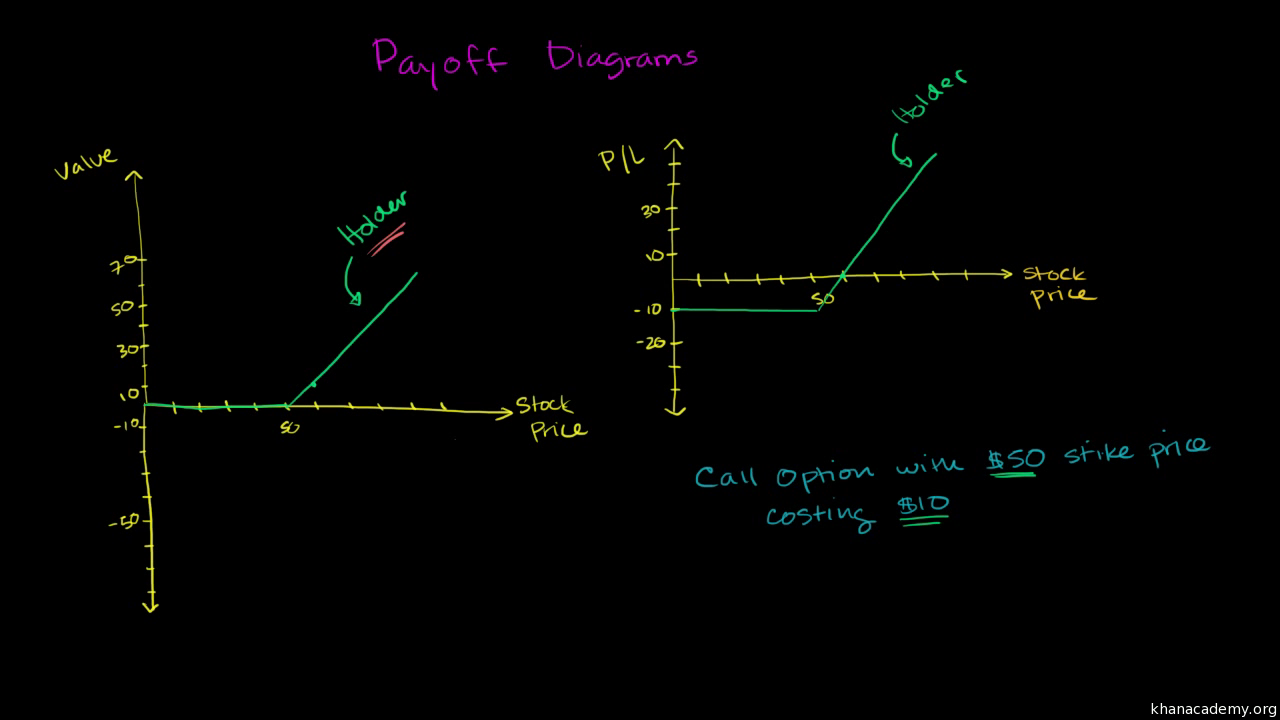

I am having trouble wrapping my head around some text provided to us by our lecturer unfortunately he is currently unavailable. The option is a contract that gives you the right to buy the stock in one year for Today people are trading the stock for 20, so you can sell the stock short for 20 today, meaning, someone gives you 20 cash today in return for a stock IOU, where you are obligated to deliver the stock to them on a later date.

So you get 20 cash upfront but you need to spend 3 of it to buy the option.

After one year this net 17 reinvested becomes Of course the stock could end the year below 18, and then you wouldn't use the option to buy back the stock, you would just buy the stock at whatever price it trades in the market.

So either you make.

By posting your answer, you agree to the privacy policy and terms of service. By subscribing, you agree to the privacy policy and terms of service. Sign up or log in to customize your list.

Stack Exchange Inbox Reputation and Badges. Questions Tags Users Badges Unanswered. Quantitative Finance Stack Exchange is a question and answer site for finance professionals and academics.

Join them; it only takes a minute: Here's how it works: Anybody can ask a question Anybody can answer The best answers are voted up and rise to the top.

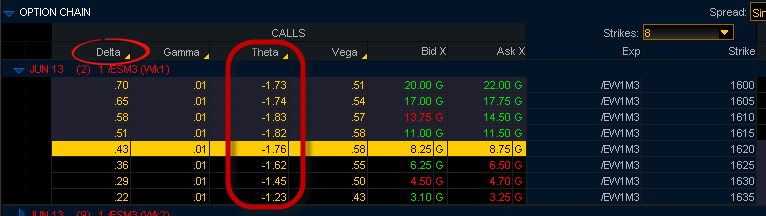

Call option arbitrage opportunity. Louis Marascio 3, 1 20 If the stock never moved.. The risk premium over and above the intrinsic implies a distro of stock returns So all joking aside There's risk from hedging, cost of borrowing..

Options Arbitrage

Anything below that presents an arbitrage opportunity. Obviously the OP has made clear that he made a lot of simplifying assumptions.

Thus, we are talking about a theoretical arbitrage opportunity absent of any transaction costs, liquidity issues, dividends, Perhaps my original post should have asked how exactly the above quoted arbitrage strategy works. You buy back the stock at whatever price it is traded at, you exercise the call if the stock price is above your strike at expiry and you get back your investment of 17 plus interest.

Put-Call Parity And Arbitrage Opportunity

At maturity you're left with You exercise the call option buying 20 worth of stock for 18, you return this stock. You now have 0. Alternatively, you buy 20 worth of stock for 18, sell it for 20, pocket 2, you now have Riaz Rizvi 1 4. Sign up or log in StackExchange. Sign up using Facebook. Sign up using Email and Password. Post as a guest Name.

In it, you'll get: The week's top questions and answers Important community announcements Questions that need answers. Quantitative Finance Stack Exchange works best with JavaScript enabled.

MathOverflow Mathematics Cross Validated stats Theoretical Computer Science Physics Chemistry Biology Computer Science Philosophy more 3. Meta Stack Exchange Stack Apps Area 51 Stack Overflow Talent.