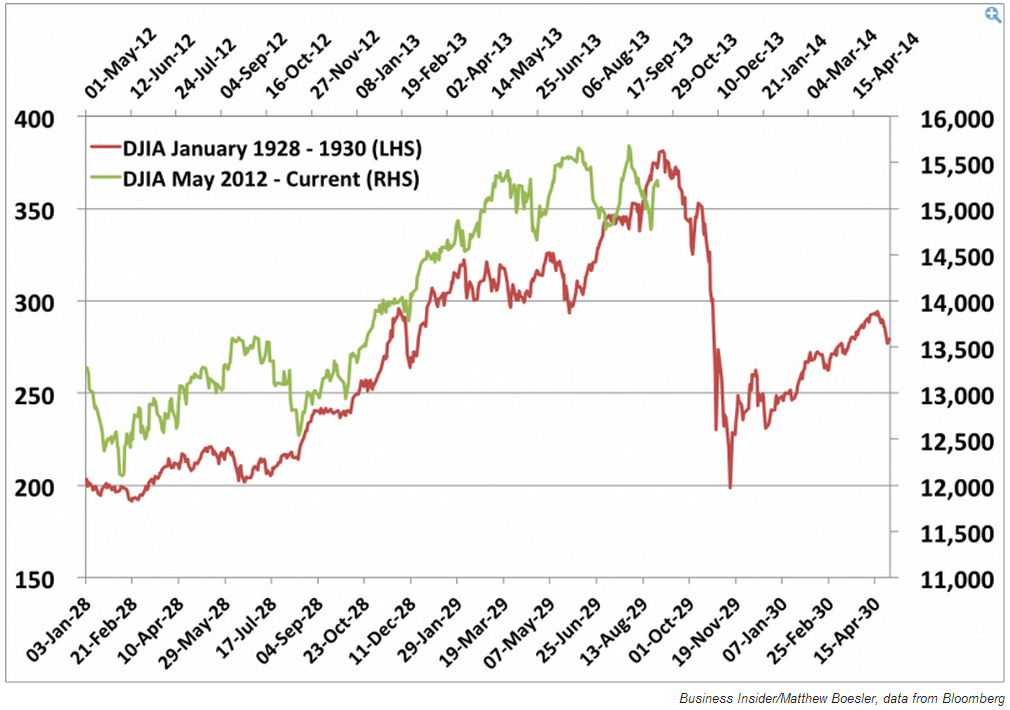

Stock market chart 1929 to 1950

Will the stock market crash in ? It seems quite unlikely that the largest economy in the world will slip into a recession in and the U. After all, the broader stock exchanges are—even after minor pullbacks—near record levels. Stocks are overvalued, and the U. Stock have soared a whole lot higher since those early warnings.

Since Trump said he had lost faith in stocks and that a recession was coming, the major indices have extended their gains and remain near record territory. The Dow Jones Industrial Average DJIA has advanced Since the first presidential debate on September 26,the DOW is up 8.

Sure, some have said it was to avoid a conflict of interest. But recall, if you will, Trump has said on numerous occasions: Still, one has to wonder if Donald Trump sold his stocks because he wanted to avoid the appearance of a conflict of interest, because his dislike for Wall Street is well known, or because he also believes that the markets are overvalued. The same Wall Street analysts who failed to make stock market crash predictions before the stock market collapse in are ignoring the same warning signs today.

The economy remains fragile, and the outlook for the stock market remains extremely volatile. The Great Crash of Stock market crashes happen because stocks are in a bubble.

Stock prices are higher than what the stocks are worth, and stocks eventually crash, bringing valuations more in line. What leads to a stock market collapse?

How do we know stocks are overvalued? Because two of the most trusted stock market valuation ratios say they are. The year average is around 16; today the ratio is at There are two ways to approach that number: The ratio, for which Robert Shiller won the Nobel Prize in economics, has only been higher twice, for longer: This does not mean that U.

There is too much euphoria in the markets since Trump won the election. And the Case-Shiller ratio is not as dramatic as it was inwhen it stood near 45 it was only at 30 in But, according to Shiller, the stock market euphoria and irrationality will eventually hit a ceiling and could send stocks plummeting in a rerun of the stock market collapse.

The market-cap-to-GDP ratio compares the total price of all publicly traded companies to GDP. The market cap to GDP ratio is currently xm forex wiki To put that into perspective, the market-cap-to-GDP ratio has only been higher twice since Init was at What about the financial crisis? The major indices are near record highs, not because investors are excited about strong corporate earnings and revenue growth though.

Stock valuations are at dangerous levels because of years of artificially low interest rates and financial engineering.

Artificially low interest rates were supposed to make it cheap to borrow money. The only thing we know for certain is that artificially low interest rates gutted retirement portfolios that relied on fixed income investments like bonds, CDs, and Treasuries. Income-starved investors and retirees were forced to put their money in risky investments like the stock market. As for financial engineering, companies propped up their corporate earnings by announcing severe cost-cutting measures and record share buyback programs.

You can only rely on this trick for so long. Eventually investors will want to know that earnings per share EPS growth is coming from increased earnings, not financial engineering. They may have a while to wait before that sinks in though. Stock market closed on mlk stock repurchases hit a record level inthey slowed in the June—September period of But stock repurchases have spiked since then.

The interest in corporate buybacks is back in fashion again after Trump won the election. Wall Street expects that his promised tax cuts will put more money back into company coffers. Companies are supposed to use the influx of cash for development and hiring. But history has shown us that kmart hours new years day money the money makeover dave ramsey tax holidays tends to go to dividends and share repurchase programs, both of which have the added effect of stock market chart 1929 to 1950 stock valuations even higher, and stretching the stock market bubble even thinner.

That is a bubble that President Trump has said is already fat and ugly. Remember, the stock market outlook is only stock market chart 1929 to 1950 strong as the underlying stocks, and those stocks forex institute only as strong as the economies that forexplaat bedrukken them.

By all accounts, the U. In December, the U.

S&P Index - Wikipedia

One of the reasons why the U. In Aprilthe number of Americans not in the workforce was The types of jobs being created are underwhelming, and wage growth is lagging. The biggest area of growth was the service industry, withjobs added. It added 55, in April Inmanufacturing employment fell by 45, The pre-recession level was 4. Many Americans, it seems, are not even aware the U.

The underemployment rate is struggling at 9. Keep in mind, the U. The global economic outlook also remains muted.

In anticipation of the well-deserved downtrend, correction, and crash, investors can hold physical gold, gold mining shares, or gold mining, physical exchange-traded funds ETFs.

Signup to receive our FREE Lombardi Letter investment newsletter along with our special offers and get our report:. Proven Stock Market Crash Indicator Just Flashed Red.

This is an entirely free service. No credit card required. You can opt-out at any time. We hate spam as much as you do. Check out our privacy policy. Our Experts Michael Lombardi, MBA Read More John Whitefoot, BA Read More Moe Zulfiqar, BAS Read More Alessandro Bruno, BA, MA Read More Benjamin A. Economic Recession Ahead. Home About Us Meet our Editors Michael Lombardi John Whitefoot Moe Zulfiqar Alessandro Bruno Benjamin A.

Smith Categories News Stock Market U.

Scary market chart gains traction - MarketWatch

This Could Trigger a Stock Market Collapse John Whitefoot, BA Lombardi Letter T This Could Trigger a Stock Market Collapse By John Whitefoot, BA May 16th, Could This Spark a U. Financial Collapse in ? The Stock Market Bubble Could Burst in and It Will Be Worse Than The Financial Crisis Explained.

Signup to receive our FREE Lombardi Letter investment newsletter along with our special offers and get our report: Proven Stock Market Crash Indicator Just Flashed Red This is an entirely free service. Alessandro Bruno, BA, MA. Recent Articles Commercial Loan Growth Signals at U. There Is a Major Economic Threat to the U. A Golden Opportunity for Stock Market Investors Click Here to get this report.

The Stock Contraian Investors' Best Play Of the Decade Click Here to get this report. Click Here to get this report. Our Editors Michael Lombardi John Whitefoot Moe Zulfiqar Alessandro Bruno Benjamin A. Categories News Stock Market U. No part of this document may be used or reproduced in any manner or means, including print, electronic, mechanical, or by any information storage and retrieval system whatsoever, without written permission from the copyright holder.