Stock market going to crash again

Markets are at record highs, but optimism breeds recklessness. The question is how big the bubble will get before it bursts. Thursday 16 February A ll three main measures of the health in the stock market are at record levels. Donald Trump is bragging about the boost he has given to share prices. Bourses around the world are taking their lead from Wall Street and heading higher.

What does that mean? It means the stock market is going to crash because sooner or later optimism breeds recklessness and boom will turn to bust. Stock market hits new high with longest winning streak in decades. Great level of confidence and optimism - even before tax plan rollout! Markets are in that part of the cycle where every piece of news is a reason to buy equities.

A sign that the global economy is picking up speed, which is good for corporate profits. Hints from the Federal Reserve that it is contemplating another increase in US interest rates? Wall Street is also salivating at the prospect of nice fat tax cuts from Trump. The White House will announce details of its plans shortly but they are certain to involve a hefty cut in corporation tax.

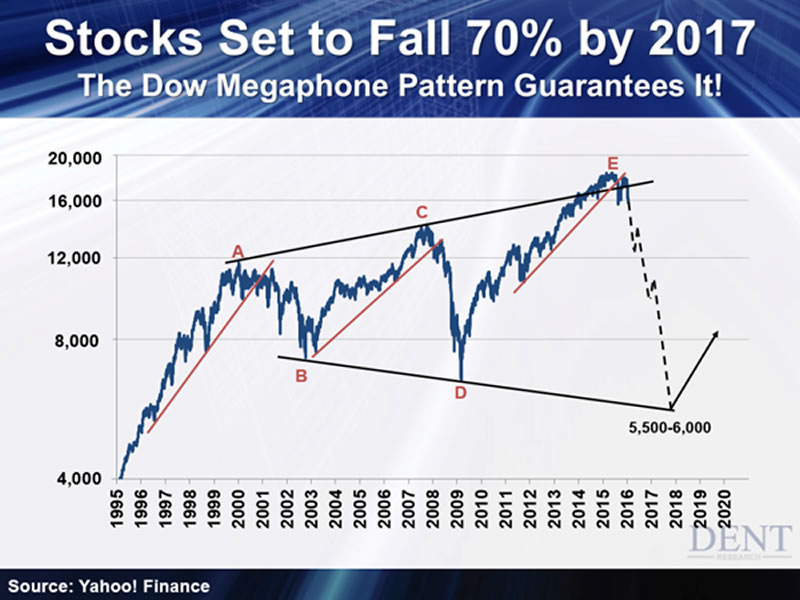

80% Stock Market Crash To Strike in , Economist Warns - The Sovereign Investor

Another reason to pile into the stock market. The other indication of a bubble mentality is that all bad news is ignored or downplayed. So, investors seem blissfully unconcerned that Trump might trigger a new global trade war or by his chaotic foreign policy. The risks of a victory for the far right in the imminent Dutch and French elections are being brushed under the carpet.

Keynes provided the best explanation for this kind of herd behaviour, noting that markets can remain irrational longer than investors can stay solvent. A fund manager might think stocks are already richly valued but if everybody else is buying then the temptation is to swallow any doubts and do likewise.

Traditionally, one of the best yardsticks for whether shares are over-valued or under-valued has been the cyclically adjusted price earnings ratio constructed by the economist Robert Shiller. This ratio is currently at about 29 and has only twice been higher: For the time being, Wall Street is being supported by negative real interest rates and the prospect of tax cuts to come. That means stock market records will continue to be broken over the months ahead.

Until the moment comes when traders get spooked by rising interest rates, burgeoning budget deficits, protectionism or a combination of all three. Wall Street is getting intoxicated on irrational exuberance. Three-quarters of respondents said business rates were the single biggest issue affecting them, a long way ahead of economic uncertainty. The Treasury is coming up against two of the iron laws of taxation.

Any changes create losers as well as winners. And the losers tend to be a lot more vociferous than the winners. The current changes are proving particularly controversial. Business rates are an annual tax on commercial properties based on their rental value and the latest uprating is based on changes in property prices since That has led to glaring anomalies. The government has made much of the progress it has made in cutting corporation tax but business rates are far more important for most companies, particularly the smaller ones.

Unless ministers want to see even more charity shops in high streets they should make good on pledges to provide transitional relief. Even better would be a reduction in business rates paid for by a penny on corporation tax. Please choose your username under which you would like all your comments to show up.

You can only set your username once. International edition switch to the UK edition switch to the US edition switch to the Australia edition. The Guardian - Back to home. Trump realDonaldTrump Stock market hits new high with longest winning streak in decades.

World stock markets hit record highs — business live. Global economy Economics Inflation US economy US interest rates comment. Order by newest oldest recommendations. Show 25 25 50 All.

Will The Stock Market Crash Again Soon?

Threads collapsed expanded unthreaded. Loading comments… Trouble loading? Signed in as Show comment Hide comment.

The Next Stock Market Crash Prediction for - The Wall Street Examiner

Your comments are currently being pre-moderated why? Please keep comments respectful and abide by the community guidelines. Rethink rates now or face retail disaster, shops tell chancellor.

Analysts suggest rising inflation is starting to rattle consumers as pre-Christmas boom comes to an abrupt halt and even once-buoyant car sales slip back. We ask top financial advisers if it is a safe bet for your money. Savers need a balancing act to beat inflation. Savings rates have never been so low, but with a spread of sensible investments your portfolio can still deliver good returns.

Budgens closes 34 stores with loss of jobs. World stocks hit record highs as Dow keeps rising - as it happened. Business chiefs tell chancellor: The Guardian back to top.