1933 stock market

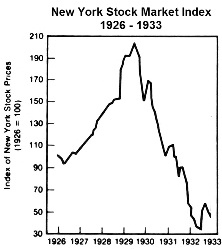

It may turn out to be a year bottom in nominal terms. How does the picture look compared to the bottom?

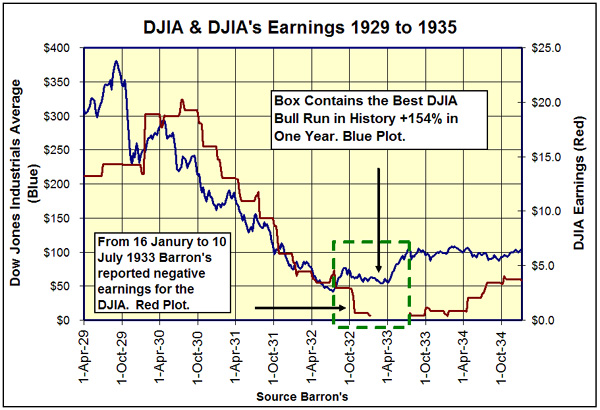

I started the chart 6 months prior to the bottom and, in addition, the line is scaled so that the bottom aligns with the bottom. As usual, click on image for a bigger picture. Price Performance The rally is considered to be the biggest stock market rally in American history do note that the numbers can vary slightly if you use a different index, such as the DJIA. As you can see, the current rally from the bottom is almost as powerful and ranks as the 2nd biggest rally in history.

Interestingly, both, the bottom and the bottom, appear to be set in April. After a little over an year from the bottom, the current rally is approaching the returns posted by the rally. If the current rally continues, it will surpass the rally pretty soon. Valuations The next question is valuation.

Both rallies appear to be similar but it would make a big difference if one is off a lower valuation. For reference purposes, I have reproduced them below: But it's hard to say for sure.

The march CAPE was When interest rates are low i. Having said all that, there is one indicator that clearly flags the fact that stocks were much cheaper in So, overall, stocks were cheaper at the bottom in than in The bottom is very confusing given the huge bank write-offs—some of those losses may reverse—but it wasn't very cheap.

As for the present i. In my mind, there is no question that the current valuation is very high compared to the April valuation. In fact, it appears that the current rally has been so great that stocks have become overvalued so quickly from a major bottom. It's amazing that the CAPE, which is a 10 year average and hence doesn't usually move much in an year, has gone from This is especially important given that the present interest rate of 3.

If the current rally continues for a bit longer, it will surpass the rally. Valuations looked low, although not exceptionally low, during the bottom but they have risen significantly in the last year.

The increase in valuation contrasts with the rally, which didn't see valuations rise quite as much.

Ford Coupe Stock Images, Royalty-Free Images & Vectors | Shutterstock

The current valuation appears to indicate that the market is nowhere near cheap. A CAPE of 22 is in the upper range of the historical data. Future returns are likely to be low unless earnings rebound. If earnings can rebound strongly from here, the situation wouldn't be so bad. Given how I'm expecting corporate taxes to go up and a greater share of economic profits to go to workers, I don't think we'll see significant increase in earnings.

Stock Price - Sysken Corp. Stock Quote (Japan: Tokyo) - MarketWatch

But there is one hope. That hope is that bank write-downs of questionable assets start reversing. If financial institutions can start writing up the assets they wrote down in the last couple of years, the situation would improve. So far, bonds, particularly junk bonds, have recovered strongly; but mortgage bonds and consumer loans still appear weak.

I was expecting to see strong deflation in the period but that was not the case at all. In fact, inflation from the bottom to April was higher than from the bottom to April The rally from March to April posted a Thinking more, I guess I shouldn't have been surprised.

After all, the gold exchange standard was removed and that probably played the main role in jump starting the economy. I personally don't buy that argument and think dividend yields can be compared across time.

There is some merit to that view on its own. However, if you are comparing to that clearly doesn't mean much, given how also had a poor economic environment with possibly low earnings and weak dividend payouts.

Copyright Can Turtles Fly? Wordpress Theme By Web Hosting Blogger Template by Blogspot Temlates. Home Websites Reference Watchlist Portfolio Personal Blog.

Subscribe Subscribe Subscribe to Can Turtles Fly? Sunday Spectacle LVII Stock market performance from two bottoms - v One year industry performance from a potential mul Time to start curbing the growth of deriv SEC's Goldman Sachs case appears to unravel before Sunday Spectacle LVI SEC charges Goldman Sachs with fraud Is there a real estate bubble in China?

Behind the scenes look at Hugh Hendry Sunday Spectacle LV Canada's largest IPO in a decade: Sign of looming pension crises Sunday Spectacle LIV Does the working population drive asset returns? US Treasury bond debate - Jim Grant vs David Rosen Popular Posts last 30 days.

Warren Buffett's Evolution and his Three Investment Styles.

Real Estate Contribution to Canadian Provincial GDP source: BCE, Huntsman, Q9 Networks. Thoughts on some risk arbitrage items BCE Saga Well, it looks like there is another lawsuit against the BCE buyout.

Syngenta SYT -- Tender Offer Accepted. Central Bank Money Printing Central banks generally increase assets by printing money and buying them, so the charts below are indicati TO AbitibiBowater ABH ABN-Amro ABN Addax Petroleum TSX: AXC Africa Aggreko LSE: AGK agriculture AIG Alliance Semiconductor PK: ALSC alternative assets Amazon AMZN Ambac ABK Anadarko Petroleum APC Andy Xie Apple AAPL Asia Aspen Exploration OTC: ASPN Atlas Mara LSE: ATMA Australia and New Zealand Bank of America Barnes and Noble BKS Bear Stearns BSC Beazer Homes BZH Bell Canada Enterprises BCE ben Benjamin Graham Berkshire Hathaway BRK.

A Bill Miller Bitcoin bonds and credit instruments book industry BOOK SUMMARY BP brands Brazil Britain BRK.

B Bruce Berkowitz Bruce Greenwald business analysis business culture BYD HK: CDCO commentary commodities communications Compass Minerals CMP contrarian corporate accounting corporate governance corporate law corporate strategy crime currencies cyclicals David Einhorn David Rosenberg Dean Foods DF deflation delta financial DFC demographics Diagoe DEO digital economy dividends Don Coxe Dubai Dynegy DYN Eastman Kodak EK economics econopolitics education Edward Lampert electric vehicles emerging markets En Pointe Technologies ENPT energy Energy East EAS Enron entrepreneurship Europe executive compensation Expedia EXPE Facebook FB fair-value accounting financials Fitbit FIT Fording Canadian Coal Trust FDG; TSX: UN forestry Foundry FDRY Francis Chou fundamental analysis Gary Shilling GenOn GEN Geoff Gannon George Soros global Globaltrans LSE: GLTR gold Goldman Sachs Google government Great Depression great investors guest-tek GTK.

TO harmony HMY healthcare hedge funds Howard Marks Hugh Hendry humour Icahn Enterprises IEP Iceland India Ingram Micro IM insightful institutional investing interesting investing track record investment evaluation investment plan investment psychology investment strategy Jaclyn JLN Jae Jun James Montier Jamie Dimon Japan Jared Diamond jds uniphase JDSU; JDS.

TO Jean-Marie Eveillard Jeremy Grantham Jim Chanos Jim Grant Jim Rogers John Hussman John Mauldin John Paulson John Templeton Kanaden Kenneth Cole Productions KCP Keyence Khan Resources KRI. TO Krishnamurthy 'Nandu' Narayanan Latin America Lehman Brothers Lexmark LXK Li Lu liquidation Live Nation LYV Lloyd Blankfein Louis-Vincent Gave Magic Software MGIC Malcolm Gladwell management Manitoba Telecom Services TSX: MBT Marc Faber marijuana Mark Zuckerberg market valuation marketing Martin Whitman Mathstar PK: MATH Matt Levine MBIA MBI media Mega Brands TSX: MB menu mergers and acquisitions Michael Lewis Michael Pettis Miscellaneous mobile devices Mohnish Pabrai monoline bond insurers Monsanto MON Montpelier Re MRH Motors Liquidation Trust MTLQU name Nassim Nicholas Taleb Netflix NFLX new york times NYT Newbie Thoughts newspapers newsprint Nokia NOK North Korea opinion origin owens corning OC; OCWAZ.

PK Paul Desmaris Paul Krugman Penn National Gaming PENN personal finance Peter Thiel Phil Falcone politics portfolio performance portfolio transactions Prem Watsa Priszm Income Fund TSX: UN private equity Puget Energy PSD Pulte Homes PHM; PHA Raj Rajaratnam's Galleon Ray Dalio real estate Reed Hastings reference retail industry revlon REV Richard Branson Robert Prechter Russell Napier Russia Sam Zell Sears Holdings SHLD Seiko TSE: TO spectrum brands SPC sports Sprott Molybdenum TSX: Joe Company JOE Staples SPLS Stephen Jarislowsky Stephen Roach Steve Jobs Sunday Spectacle Suruga Syngenta SYT Takefuji Talisman Energy TLM tax tech cyclicals technology Ted Turner The Year That Was Thornburg Mortgage TMA; TMA-E Tim McElvaine timber Todd Combs Toronto TorStar TS.

B tourism Toyota Industries traders transportation Tribune TRB turtle Turtle Awards useful USG USG Verenex Energy TSX: VNX Virgin America VA Walter Schloss Warren Buffett watch list actions WikiLeaks William Ackman year-end review yen carry-trade.

About This Blog An investment blog chronicling a slow-moving turtle's attempt at gaining financial independence.

Wall Street Crash of - Wikipedia

Mostly contrarian investing with value-investing tilt and influenced by macroeconomics. Feel free to visit my non-investment blog describing my life and thoughts. About Me Sivaram Velauthapillai View my complete profile. Stock market performance from two bottoms - vs April 25, at 6: Newer Post Older Post Home.