Forex hedge technique

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, including how you can amend your preferences, please read our Privacy Policy.

If we had to sum up hedging in as few a words as possible, we could probably trim it down to just two:. For example, an airline is exposed to fluctuations in fuel prices by the inherent cost of doing business. Such an airline might choose to buy oil futures in order to mitigate against the risk of rising fuel prices.

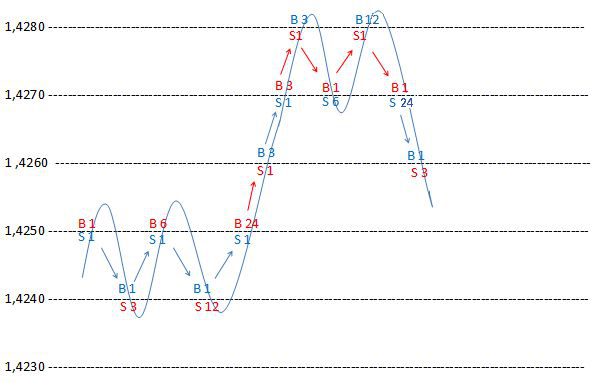

For a fuller explanation about this kind of hedging, take a look at our article explaining what Forex hedging is. Are there no loss Forex hedging strategies and techniques where you take positions with the intention of profit, but also mitigate your risk? There is a number of different Forex hedging strategies that aim to do this to varying degrees. The real trick of any Forex hedging technique and strategy is to ensure the trades that hedge your risk don't wipe out your potential profit.

The first Forex hedge strategy we're going to look at seeks a market-neutral position by diversifying risk. Because of its complexity, we aren't going to look too closely at the specifics, but instead discuss the general mechanics. Hedge funds exploit the ability to go long and short in order to seek profits while only being exposed to minimal risk.

The strategy relies on the assumption that prices will eventually revert to the mean, yielding a profit. In other words, this strategy is a form of statistical arbitrage.

The trades are constructed so as to have an overall portfolio that is as market-neutral as possible.

Forex Strategy: The US Dollar Hedge

Consequently it is a challenge simply to stay on top of measuring the relationships between instruments. It is a further challenge to act on the information in a timely manner and without incurring significant transaction costs. With stocks, there are clear and easy commonalities between companies that operate in the same sector. The good news is that MetaTrader 4 Supreme Edition comes with a Correlation Matrix, along with a host of other cutting-edge tools. Another way to hedge risk is to use derivatives that were originally created with this express purpose.

The fixed price at which the option entitles you to buy or sell is called the strike price or exercise price.

The price or premium of an option is governed by supply and demand, as with anything traded in a competitive market.

The interesting thing about options is the asymmetrical way in which their price changes as the market goes up or down. This means if you bought the call, you have unlimited upside with a strictly limited downside. This opens the door to a wealth of possibilities when it comes to your hedging Forex strategy. You've taken the position to benefit from the positive interest rate differential between Australia and the US.

But if its net movement is downward more than an average of 0. Your real concern is a sharp drop, which could significantly outweigh any gains from the positive SWAP. The risk profile of a put is that you have a fixed cost i. By buying the put, you have reduced your maximum downside on your long trade to just pips.

That's because the intrinsic value of your put starts increasing once the market drops below its exercise price. Add in the 61 pip cost of the option's premium in the first place, and your total downside is pips, as stated above.

The act of hedging delays the risk, but the compromise is in how this affects your potential profit.

They are happy to give up their chance of making a speculative profit in exchange for removing their price exposure. Their complexity, though, means they are better suited to traders with more advanced knowledge.

This allows you to fully tailor your best Forex hedge strategy to properly suit your attitude to risk. If you want to practise different Forex hedging strategies, trading on a demo account is a good solution. Because you are only using virtual funds, there is no risk of an actual cash loss and you can discover how much risk suits you personally. Trading foreign exchange or contracts for differences on margin carries a high level of risk, and may not be suitable for all investors.

There is a possibility that you may sustain a loss equal to or greater than your entire investment.

Forex Hedge & Currency Hedging Strategy - Forex - Investopedia

Therefore, you should not invest or risk money that you cannot afford to lose. You should ensure you understand all of the risks. Before using Admiral Markets UK Ltd services please acknowledge the risks associated with trading. The content of this Website must not be construed as personal advice. Admiral Markets UK Ltd recommends you seek advice from an independent financial advisor. Admiral Markets UK Ltd is fully owned by Admiral Markets Group AS.

Admiral Markets Group AS is a holding company and its assets are a controlling equity interest in Admiral Markets AS and its subsidiaries, Admiral Markets UK Ltd and Admiral Markets Pty. All references on this site to 'Admiral Markets' refer to Admiral Markets UK Ltd and subsidiaries of Admiral Markets Group AS.

Admiral Markets UK Ltd. Clare Street, London EC3N 1LQ, UK.

What is hedging as it relates to forex trading?

About Us Why Us? Regulatory Authorisation Admiral Markets UK Ltd is regulated by the Financial Conduct Authority in UK. Contact Us Leave feedback, ask questions, drop by our office or simply call us. Partnership Enhance your profitability with Admiral Markets - your trusted and preferred trading partner.

Careers We are always on the lookout to add new talent to our international team. Press Centre Get the latest Admiral Markets press releases and find our media contacts in one place, whenever you want them Order execution quality Read about our technologies and see our monthly execution quality report. Account Types Choose an account that suits you best and start trading today. Top products Forex Commodities Indices Shares Bonds.

Contract Specifications Margin requirements Volatility Protection. Learn more about this plugin and its innovative features. MT4 WebTrader Use MT4 web trading with any computer or browser no download necessary. Fundamental Analysis Economic events influence the market in many ways. Find out how upcoming events are likely to impact your positions. Technical Analysis Charts may show the trend, but analysis of indicators and patterns by experts forecast them.

See what the statistics say. Forex Calendar This tool helps traders keep track of important financial announcements that may affect the economy and price movements.

Autochartist Helps you set market-appropriate exit levels by understanding expected volatility, impact of economic events on the market and much more. Trader's Blog Follow our blog to get the latest market updates from professional traders. Market Heat Map See who are the top daily movers. Movement on the market always attracts interest from the trading community.

Market Sentiment Those widgets help you see the correlation between long and short positions held by other traders. Learn the basics or get weekly expert insights. FAQ Get your answers to the frequently asked questions about our services and financial trading. Trader's Glossary Financial markets have their own lingo.

Double your Forex Broker Account with the non directional, hedged, GTM Forex Trading TechniqueLearn the terms, because misunderstanding can cost you money. Held by trading professionals. Risk Management Risk management can prevent large losses in Forex and CFD trading. Learn best-practice risk and trade management, for successful Forex and CFD trades.

Zero to Hero Start your road to improvement today. Our free Zero to Hero program will navigate you through the maze of Forex trading. Forex Have you ever fancied giving trading a go?

Check out our free online Forex education course and learn to trade in just 3 steps! Admiral Club Earn cash rewards on your Forex and CFD trading with Admiral Club points. Play for fun, learn for real with this trading championship. Personal Offer If you are willing to trade with us, we are willing to make you a competitive offer. About Us About Us Why Us?

How to use a Forex hedging strategy to look for lower-risk profits. Android App MT4 for your Android device. MT4 WebTrader Trade in your browser. MetaTrader 5 The next-gen. MT4 for OS X MetaTrader 4 for your Mac. Forex and CFD trading may result in losses that exceed your deposits. Please ensure you understand the risks involved. Regulatory Authorisation Contact Us News Testimonials Partnership Careers Press Centre Order execution quality.

Products Forex Commodities Indices Shares Bonds Contract Specifications Margin requirements Volatility Protection. Platforms MetaTrader 4 MT4 Supreme Edition MT4 WebTrader MetaTrader 5.

Analytics Fundamental Analysis Technical Analysis Wave Analysis Forex Calendar Autochartist Trader's Blog Market Heat Map Market Sentiment.