Marginal cost of preferred stock formula

The following sections discuss the cost of capital in terms of its components, calculations, and company internal targets.

How to Calculate the Marginal Cost of Capital | The Finance Base

Readers should know the costs that make up the weighted cost of capital WACC. Interpreting the Cost of Capital Given the importance of capital budgeting, a company should use the weighted average of the costs of the various types of capital it may use in financing its operations.

A company uses debt, common equity and preferred equity to fund new projects, typically in large sums. In the long run, companies typically adhere to target weights for each of the sources of funding.

When a capital budgeting decision is being made, it is important to keep in mind how the capital structure may be affected. Cost Components A company's weighted average cost of capital WACC is comprised of the following costs: Cost of debt 2.

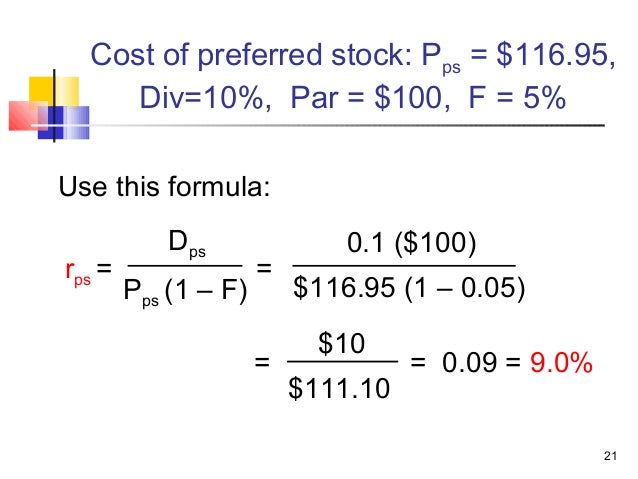

Cost of preferred stock 3. Cost of retained earnings 4. Cost of external equity. Cost of Debt In the WACC calculation, the after-tax cost of debt is used. Using the after-tax cost takes into account the tax savings from the tax-deductibility of interest. Cost of Preferred Stock Cost of preferred stock k ps can be calculated as follows: Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

What is Weighted Marginal Cost? | dakoxok.web.fc2.com

The Cost of Capital By Investopedia Share. Chapter 1 - 5 Chapter 6 - 10 Chapter 11 - 15 Chapter 16 - Ethics and Standards 2. Global Economic Analysis 1. Knowledge of the Law 1. Independence And Objectivity 1. Material Nonpublic Information 1.

Weighted Average Cost of Capital (WACC) - Finance Train

Loyalty, Prudence And Care 1. Preservation Of Confidentiality 1. Duties to Employers, Standard IV-A: Additional Compensation Arrangements 1.

Responsibilities Of Supervisors 1. Diligence And Reasonable Basis 1. Communication With Clients And Prospective Clients 1. Disclosure Of Conflicts 1. Priority Of Transaction 1. Composites And Verification 1.

Disclosure And Scope 1. Requirements And Recommendations 1. Fundamentals Of Compliance And Conclusion 2. Real GDP, and the GDP Deflator 4. Pegged Exchange Rate Systems 5. Fixed Income Investments The Tradeoff Theory of Leverage The Business Cycle The Industry Life Cycle Intramarket Sector Spreads Calls and Puts American Options and Moneyness Long and Short Call and Put Positions Covered Calls and Protective Puts.

Cost of external equity 1. The after-tax cost of debt can be calculated as follows: What is Newco's cost of debt? Weighted average cost of capital may be hard to calculate, but it's a solid way to measure investment quality. Learn about the importance of capital structure when making investment decisions, and how Target's capital structure compares against the rest of the industry.

Cost of debt is the rate, expressed as a percentage, that a company pays on its borrowings.

Learn to use the composition of debt and equity to evaluate balance sheet strength. The required rate of return is used by investors and corporations to evaluate investments.

Find out how to calculate it. Offering both income and relative security, these uncommon shares may work for you. You may participate in both a b and a k plan. However, certain restrictions may apply to the amount you can Generally speaking, the designation of beneficiary form dictates who receives the assets from the individual retirement Discover why consultant Ted Benna created k plans after noticing the Revenue Act of could be used to set up simple, Purchase life insurance in your qualified retirement plan using pre-tax dollars.

Be aware of other ways that life insurance Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.