Taleb options strategy

Several articles IIIIIIIV have recently discussed the source of Warren Buffett's alpha and strategies designed to reproduce his success. To briefly summarize, an academic study by Pedersen and coworkers concluded that Buffett's success was largely the result of three factors:.

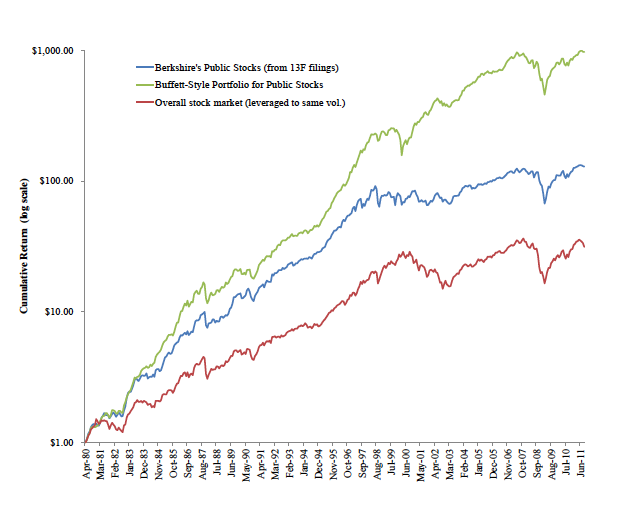

Figure 1 is an excerpt from Pedersen's article and shows the remarkable result of Buffett's investing strategy. The green line comprises a theoretical portfolio of Buffett-like stocks that the authors selected through picking the most undervalued low-beta stocks on the market with equivalent use of leverage. The blue line is the performance of Berkshire Hathaway NYSE: Notice that both Berkshire and a Buffett style portfolio had very significant drawdowns before the end of the dot-com bull market.

Just because a strategy works exceedingly well for fifty years does not mean it works well every single year, even during a raging bull market. The source of this underperformance is the extent to which overvalued tech stocks were attracting money away from value stocks at the time. Over time Berkshire realized a return By the late s Berkshire's outperformance relative to the market slowed, likely because Berkshire had become so large that suitable investment opportunities were no longer available.

Nassim Taleb, the author of The Black Swan, paints a much more subdued picture of the risk inherent to the stock market. He consistently advocates an approach toward investing that is referred to as a barbell strategy. Because tail risk can cause such drastic drawdowns in equities, Taleb recommends the use of options to create a 'bipolar' portfolio of which the major portion is invested in risk-free bonds, while the risk-taking portion is leveraged through the use of options to comprise all of the risk and volatility of the portfolio.

Taleb's Barbell Approach to Investing. The interesting aspect of these two strategies is that while thinking about Buffett, it became apparent that you could use Taleb's strategy to replicate Buffett's approach to the stock market. One undervalued Buffett-type stock that fits this approach nicely is Johnson taleb options strategy Johnson NYSE: The company appears to be deeply undervalued relative to its cash flow, has a beta of 0. The other nine thousand dollars would then be used to purchase low risk bonds.

However, just foreign currency trading wikipedia one stock does not make a portfolio, neither does a single call option. In order to diversify in the event that Johnson and Johnson underperforms you will need to find additional companies that fit the criteria mentioned above.

In order to identify additional ideas for application of this strategy I applied the following filters:. Stocks that passed these tests and represent interesting ideas for implementation of this strategy are: CBGeneral Mills NYSE: GISInternational Business Machines NYSE: IBMMcDonald's Corp.

MCDMcKesson NYSE: MCKTarget NYSE: TGTThe Traveler's Companies NYSE: TRV stock market crash suicides 1929 Exxon Mobil NYSE: For other stocks, you can set the option closer to the money or even out of the money, but this comes at the expense of a higher break-even price relative to where the stock is trading.

The above strategy is a savage axis xp 223 stock method for limiting risk without sacrificing return.

In my view, if you can replicate 1. However, there are a number of disadvantages to consider as well. While the strategy can realize long-term capital gains, you will have to turn over the portfolio once a year, forcing you to pay taxes on these gains. For example, early this year you could have bought options set to expire on the 18th of January You could then close the position just over one year hence and incur long-term capital gains tax rates, however, you could not compound your winnings absent of taxes.

By opening new positions just a few days early the cycle could repeat year after year. This would double market exposure for several days, but allow long-term tax rates to apply. Another disadvantage is that many of the stocks mentioned pay a superior dividend yield to the coupon yield on a diversified fund of bonds. Thus, the income you receive will be less when implementing this strategy.

At this stage of our present bull market, I expect this strategy is a very sound one, particularly for large cap low beta blue chips, such as the ones recommended above.

Historically, the largest cap stocks tend to outperform during the late stages of a bull market. Using this method to craft a diversified portfolio of stocks should be able to capture any remaining upside in this bull market while limiting risk if the bull is nearly over. I am long BONDIBMJNJMCDMCK.

Micro Class: Anti-Fragile Tip: The Barbell StrategyI wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it other than from Seeking Alpha.

Error (Forbidden)

I have no business relationship with any company whose stock is mentioned in this article. The above article should not be considered a solicitation to buy securities or options derived from them.

Taleb Option Trading Strategy, Learn How To Invest Correctly!

Please conduct your own due diligence and carefully consider risk vs. The long position above for JNJ refers to Jan calls on the underlying stock.

Portfolio Strategy Fixed Income Bonds Financial Advisors Retirement Editor's Picks. An Investing Strategy That Is Half Warren Buffett And Half Nassim Taleb Feb. To briefly summarize, an academic study by Pedersen and coworkers concluded that Buffett's success was largely the result of three factors: Buying the highest quality, lowest risk stocks at good prices the beta of Buffett's average holding was calculated to be approximately 0.

Want to share your opinion on this article? Disagree with this article? To report a factual error in this article, click here.

Follow Brendan O'Boyle and get email alerts.