Relation between interest rate and forex

Glossary - Aviva plc

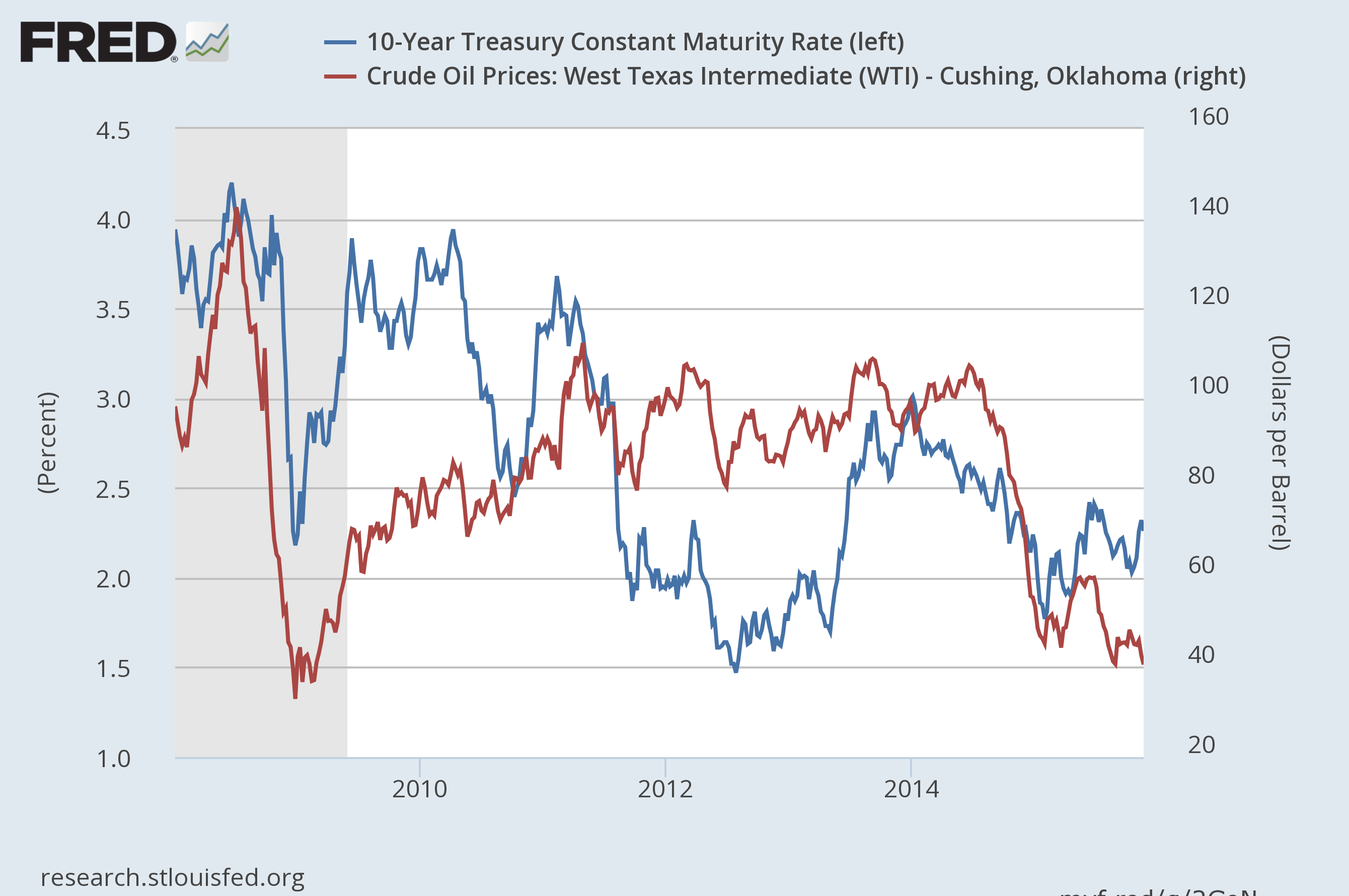

All other factors being equal, higher interest rates in a country increase the value of that country's currency relative to nations offering lower interest rates. However, such simple straight-line calculations rarely, if ever, exist in foreign exchange. Although interest rates can be a major factor influencing currency value and exchange rates, the final determination of a currency's exchange rate with other currencies is the result of a number of interrelated elements that reflect and impact the overall financial condition of a country in respect to that of other nations.

macroeconomics - How interest rate affects currency - Economics Stack Exchange

Generally, higher interest rates increase the value of a given country's currency. The higher interest rates that can be earned tend to attract foreign investment , increasing the demand for and value of the home country's currency. Conversely, lower interest rates tend to be unattractive for foreign investment and decrease the currency's relative value.

Interest Rate Differential (IRD)

However, this simple occurrence is complicated by a host of other factors that impact currency value and exchange rates. One of the primary complicating factors is the interrelationship that exists between higher interest rates and inflation.

If a country can manage to achieve a successful balance of increased interest rates without an accompanying increase in inflation, then the value and exchange rate for its currency is more likely to rise. Interest rates alone do not determine the value of a currency.

Two other factors that are often of greater importance are political and economic stability and the demand for a country's goods and services. Factors such as a country's balance of trade between imports and exports can be a much more crucial determining factor for currency value.

Greater demand for a country's products means greater demand for the country's currency as well. Favorable gross domestic product GDP and balance of trade numbers are key figures that analysts and investors consider in assessing the desirability of owning a given currency.

Another important factor is a country's level of debt. While they can be managed for some period of time, high levels of debt eventually lead to higher inflation rates and may ultimately trigger an official devaluation of a country's currency.

The recent history of the United States clearly illustrates the critical importance of a country's overall perceived political and economic stability. In recent years, U. In an attempt to stimulate the U. Despite these facts, the U.

This is partially due to the fact that the U. This fact, more so than interest rates, inflation or other considerations, has proven to be the overriding and determining factor for the relative value of the U.

Dictionary Term Of The Day.

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

How do changes in national interest rates affect a currency's value and exchange rate? By Investopedia Updated May 17, — 8: Foreign exchange, or Forex, is the conversion of one country's currency into that of another. In a free economy, a country's International currency exchange rates display how much one unit of a currency can be exchanged for another currency. Learn the respective meanings of the two terms, current account deficit and currency valuation, and understand the relationship In general, higher interest rates in one country tend to increase the value of its currency.

An in depth look at out how a currency's relative value reflects a country's economic health and impacts your investment returns.

The exchange rate is one of the most important determinants of a country's relative level of economic health and can impact your returns. Central banks and financial institutions hold large amounts of foreign money as their reserve currency.

International exchange rates show how much one unit of a currency can be exchanged for another currency.

Currency fluctuations often defy logic. Learn the trends and factors that result in these movements. A currency with a value that fluctuates as a result of the country's An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters.

All Rights Reserved Terms Of Use Privacy Policy.