Spread trading futures options

Of the questions on the Series 3 exam, you can expect around three on spreading.

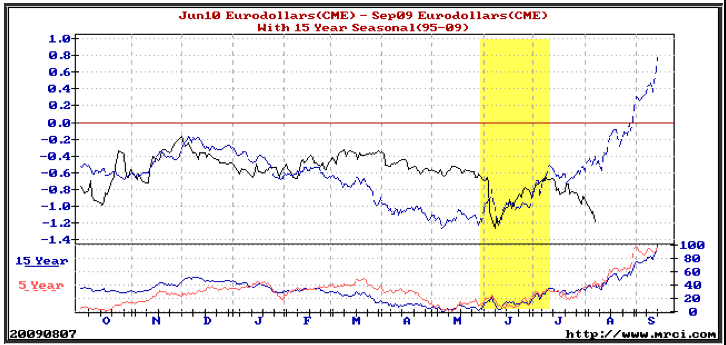

Commodity Spreads and Spread Charts

Spread trading In the preceding chapter, we described hedges, then showed examples of how you can take a primary position in the cash market and reduce the risk inherent in that position by taking a contrary position in the futures market. But let's say that the cash market is, for any number of reasons, unattractive to you as a commodity producer, as a commodity consumer or as a financial speculator. In fact, if you're trading financial as opposed to agricultural contracts, the futures exchanges may be the most robust market available.

In either case, you might want to take both your primary and your hedge position in the futures market. Definition and Objective A spread combines both a long and a short position put on at the same time in related futures contracts.

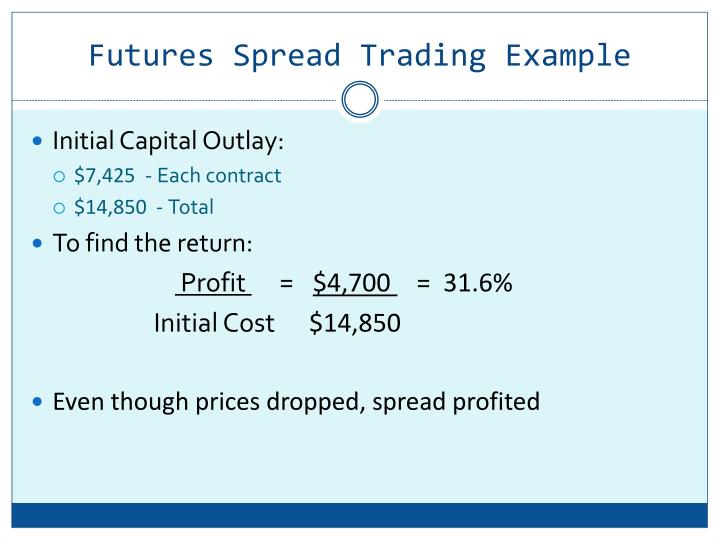

The idea behind the strategy is to mitigate the risks of holding only a long or a short position.

For example, a trade may have put on a spread in gold. If gold increases in price, the gain on the long position will offset the loss on the short one. If gold were to fall, the reverse would hold. As with any protective trading arrangement, a spread may be vulnerable to both legs moving in the opposite direction of what the trader may have anticipated, losing money.

Margin requirements tend to be lower due to the more risk adverse nature of this arrangement.

Futures Calendar Spread BasicsA customer is long December copper and short March silver. They both trade on the New York Mercantile Exchange. What spread is this? Please review "Chapter 4: Market Operations," particularly the "Alternative calculations" heading under the "Margin requirements" section.

In addition to reduced margin requirements, time and labor-saving devices exist for spreads. Most exchanges feature an order entry system that enables a trader to enter or exit a transaction using a " spread order ," an order listing the series of contracts that the customer wants to buy and sell, and the desired spread between the premiums paid and received for the options.

So you enter it all in on one spread order, rather than as one long position and one short position.

Alternately, a trader could independently enter each side, or " leg ," of the spread, but this is not commonly done because the spread can now be considered a single, synthesized position. As well, it is no longer a position on the price moves of the wheat itself.

It is now a position on whether the basis will narrow or widen. Expectations In the example above, the spread could actually gain or lose in value, even if there is no movement in one of the legs. As stated, one of the legs is for September delivery and it is already August. There might not be much more play in that price of that futures contract; as it approaches its expiration date, it will stick closer and closer to the spot market price. Still, December is a long way off, and one of two things will happen: If the December price goes up pursuant to our example , then the basis will widen.

If the price goes down assuming the bottom does not fall out altogether , then the basis will narrow. The spread will continue to trade as a spread, rather than as two separate positions. There is even a market in spreads as opposed to the uncovered positions. Just as futures prices are typically higher than cash prices as discussed in the preceding chapter , distant-futures prices are normally higher than nearby futures prices.

Thus, December prices will usually be higher than September prices, and so the normal state of a spread basis is to be negative.

But there are conditions that can lead to an inverted market, in which distant-futures prices may be below near-future prices, resulting in a positive basis. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Spread Trading By Investopedia Staff Share. Chapter 1 - 3 Chapter 4 - 6 Chapter 7 - 9 Chapter 10 - Orders And Price Analysis 6.

Intercommodity - though copper and silver are both metals, they are different. Intramarket - both trade on the NYME. Interdelivery - one is delivered in December, the other in March.

Futures investors flock to spreads because they hold true to fundamental market factors. It's very important for every investor to learn how to calculate the bid-ask spread and factor this figure when making investment decisions.

Futures & Options Trading for Risk Management - CME Group

Writing bull put credit spreads are not only limited in risk, but can profit from a wider range of market directions. This trading strategy is an excellent limited-risk strategy that can be used with equity as well as commodity and futures options. Spread has several slightly different meanings depending on the context. Generally, spread refers to the difference between two comparable measures. Leveraged products offer investors the opportunity to get significant market exposure with a small initial deposit.

Contracts for difference and spread bets offer two ways to get more leverage.

You may participate in both a b and a k plan. However, certain restrictions may apply to the amount you can Generally speaking, the designation of beneficiary form dictates who receives the assets from the individual retirement Discover why consultant Ted Benna created k plans after noticing the Revenue Act of could be used to set up simple, Purchase life insurance in your qualified retirement plan using pre-tax dollars.

Be aware of other ways that life insurance Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.