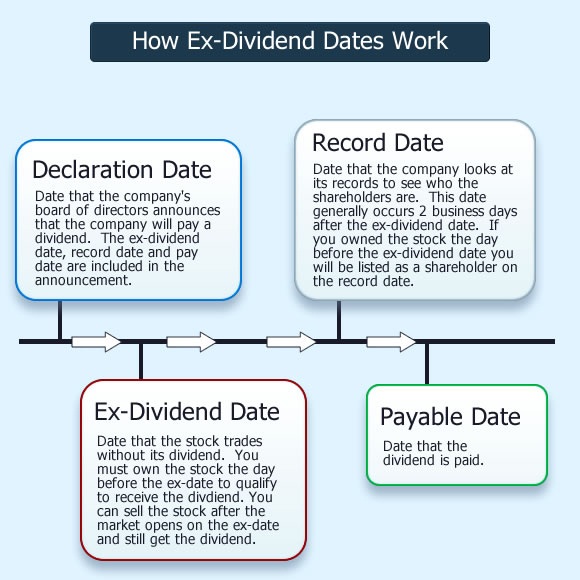

Buying stock day before ex-dividend date

The dividend capture approaches that I describe below do work some of the time.

Related Posts Assignment Risk, Short Calls, And Ex-Dividend Dates Top 11 questions about dividends Overview of dividend capture strategies Saving money with combination orders Dividend capture by buying SPY and shorting IVV? You don't actually get the real dividend, but you get the value of the dividend, which is really all you care about. Of course, there's still risk involved, so you'd need to have a mental stop loss in place for when you would get out.

I believe that an upcoming dividend tends to have a positive effect on a stock. Selling options against that stock is a good way to hedge against the major risk of the 1 or 2 strategy—a major negative move in the market that drops the stock.

Unfortunately options aren't great for this sort of short term insurance. Deep ITM calls approach 3 provides good insurance, but they negatively track the stock quite well an uptick in the stock is cancelled out, ATM calls will give you approximately half the gain, but they don't provide much insurance value, and OTM calls don't provide much insurance at all.

Selling ITM calls a few days before ex-dividend, with a premium around the dividend value, that expire within 10 days after the ex-dividend date is my preferred approach. Unless the market moves strongly against you the calls get assigned the night before ex-dividend.

Long the stock the day before ex-dividend in a Roth IRA. Sell the next day at the open. Simultaneously, short the stock in a taxable account, buy back at the open. Theoretically, and I stress theoretically, you are flat on the stock, have a tax-deductible dividend payable in the short account — and a tax-free dividend in the long account.

Dividend Stocks – Can You Buy Stock Just For The Dividend? - Show #062What am I left with? A free small tax deduction, if in a higher bracket or if dividends are to be treated as ordinary dividends. Or is the IRS going to disallow the deduction, as a form of a wash sale? Hi, I think this would work as you suggest. It might be best to wait a bit after opening to close out the positions, because ex-dividend openings tend to be messy and you want the close out prices to be very close.

If I own some shares of an XLU. I buy before exdividend and sell after the record date with a stop-loss to prevent a crash in the stock, I have a high probability of getting the dividend at low risk and if I continue to hold the stock also get the tax benefit and compounded dividends. Am I missing some risk or strategy? Seems like a high probability of success and great payout. What am I missing? If you are ok with that risk, then fine. But look at a 5 year chart of XLU and see what can happen.

Be careful with stop loss orders.. Hi Mojeaux, These indexes accrue the dividends as they are paid out and do drop when the ETF goes ex-dividend. This is easy to see comparing SPY to IVV for example when they go ex-div within a few days of each other.

Dividend capture strategies—three approaches to skip Updated: The dividend is just a bonus. An advantage of this approach is that if you hold the stock long enough then you qualify for qualified dividends which currently have a lower tax rate.

SGQI - SG Global Quality Income ETF | Janus Henderson Investors

If the stock tanks due to market action it is tempting to not sell and at least collect the dividend, but this is often a bad idea. This would be a fine strategy if the options market makers were stupid. Clearly they are not. It is tempting to sell not-so-deep ITM options to get some premium up front.

If the option expiration date is not close to the ex-dividend date this is generally a bad idea. If the premium is attractive then you typically are not very deep in the money—exposing you to market risk.

What Investors Need to Know About Ex-Dividend Dates

Unless the underlying moves strongly up your options will probably not be assigned and then you will see a nasty jump in option premium starting at opening on the ex-dividend date—making it unprofitable to close out the position until near the option expiration date.

Tuesday, September 10th, Vance Harwood. What about a combination of 2 and 3? All content on this site is provided for informational and entertainment purposes only, and is not intended for trading purposes or advice. This site is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein.

It is not intended as advice to buy or sell any securities. I am not a registered investment adviser.

Please do your own homework and accept full responsibility for any investment decisions you make.