Nifty open interest chart live

High PCR means the market is bullish because the option writers are inclined to write puts. Low PCR means bearish sentiment — because option writers are not willing to write puts but instead write calls. The put-call ratio PCR is a popular tool specifically designed to gauge the overall sentiment mood of the market. The ratio is calculated by dividing the number of traded put options by the number of traded call options.

As this ratio increases, it can be interpreted to mean that the investors are putting their money into put options rather than call options. An increase in traded put options signals that investors are either starting to speculate that the market will move lower, or starting to hedge their portfolios in case of a sell-off. The put-call ratio PCR is primarily used by traders as a contrarian indicator when the values reach relatively extreme levels.

This means that many traders will consider a large ratio a sign of a buying opportunity because they believe that the market holds an unjustified bearish sentiment and it will adjust to normal soon, once the short covering begins. Unfortunately, there is no magic number that indicates that the market has created a bottom or a top, but generally traders will anticipate this by looking for spikes in the ratio or for when the ratio reaches levels that are outside of the normal trading range.

An increasing ratio is a clear indication that investors are starting to move toward instruments that gain when prices decline rather than when they rise. Since the number of call options is found in the denominator of the ratio, a reduction in the number of traded calls will result in an increase in the value of the ratio.

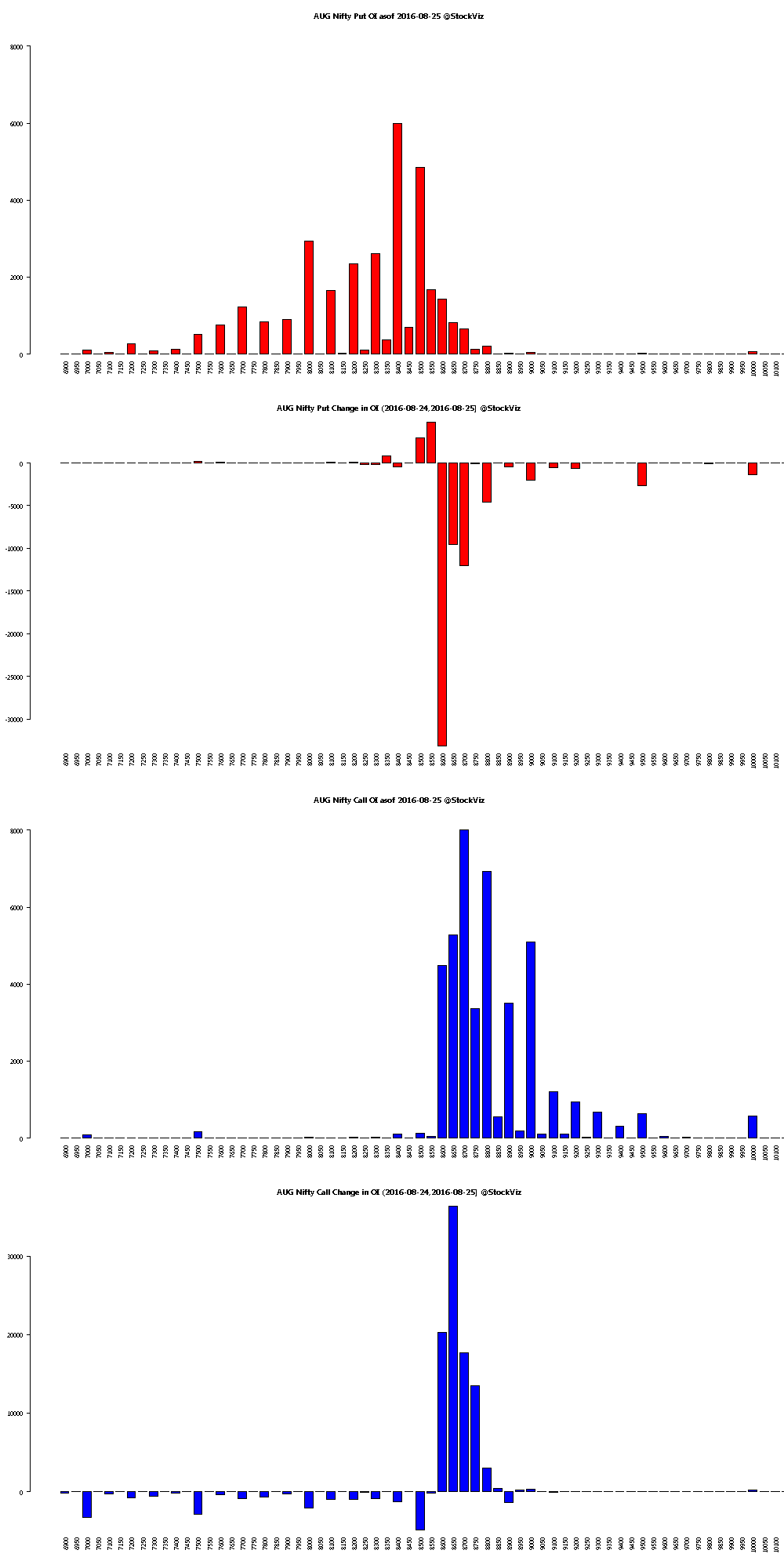

This is significant because the market is indicating that it is starting to dampen its bullish outlook. Regarding Nifty Open Interest, it provides good support and resistance levels for the series. Traders usually look for Nifty Open interest highest OI strikes. These strikes are important to determine support and resistance. Because Option Writers are generally market players with deeper pockets compared to option buyers.

It is very important for option traders to understand the relation between open interest and market direction.

Combining interpretations from Open Interest OI and change in OI can give meaning results. Open Interest data can give very useful clues to determine Support and Resistance. Similarly if huge open interest is build for calls it will be seen as major resistance zone. If the expiry is near than the market may stay range bound between these two levels.

While first and third scenarios of interpretation of open interest charts indicate direction of future market trend Bullish in first case and Bearish in third Caseother scenarios does not indicate a clear trend. Traders can wait for clarity in open interest data or use other indicators to initiate positions. March 11, at The Put Call Ratio PCR is based on the live data.

March 21, at Dear nifty11, Observation on Put Call Ratio. Please share your opinion. July 1, at Regarding OI Pivot, I use it to only gauge market strength or weakness.

But I wait for retracement before taking any position and also check other indicators. July 1, at 2: Again, Indicator is one small part of TA. Patience, Money Management, choice of instrument, discipline etc.

One cannot expect good result with TA alone. However, other things being equal, I suggest you read about the popular indicators and experiment with them. People have different biases, hence there is no indicator suitable for everyone or in every situation. Based on my experience, if you are looking for catching trend reversals, then look for momentum exhaustion.

Similarly, if you want to ride a trend, wait for retracement. July 2, at August 8, at August 17, at August 12, at 9: October 13, at 7: Hi, Everybody, I am new to this field and while understanding the PCR, I have certain queries. How, High PCR means the market has bullish sentiments…? And premium of Puts rises only if the market falls. This means the sentiment is bearish and the investors are expecting the market to fall and have bought puts to give them good returns.

In contrast, if the market rises, the puts will decrease in value and the investors who have invested in Puts will loose their money. October 13, at 9: Timstock trading house is a zero sum game. One party makes money at the expense of other. Same holds true for option buyers and sellers also known as option writers.

While both experienced and new traders buy options, the reasons for buying is very different. The new trader forex trader iphone app inexperienced trder is lured to buy options to make quick money. Option writers are usually people with deep pockets also more experiencedsince writing options require higher margin compared to option buying.

This is the reason why high PCR is considered bullish. Hope I have clarified your doubt. While markets are lot more complicated, I have simplified the dynamics for clearing your doubt. October 14, at 8: Thanks for your prompt response. But it did not clarify my doubt. Hedging is trying to nullify the losses. Also, writing options require higher margin compared to option buying is correct as unless buy put options scottrade is true you do not make a profit.

This is what it is.

Money A2Z

Secondly, in terms of higher PCR, the investors are not writing puts they are buying.! October 16, at Beginners react when there is panic or euphoria in the market. Mostly when this happens the news is already priced-in. Beginners are usually not into writing options. Beginner traders are usually lured by low risk and unlimited return potential of buying options. While the experienced writers understand the time-value decay of options.

The same puts are being written by someone who has been in the market for long time.

One party buying puts and the other selling them, so the PCR will go up. Hence the PCR has little or no impact from this. They close their position during extreme panic, while the smart trader start buying at this time. High PCR is bullish because the smart investor write Put options and buy in delivery at the same time. Similarly, they sell call options and sell in delivery at the same time. While casual or uninformed investors does just opposite.

March 13, at Hi, came to know about your site through google. If yes, then is there any option to take data from all the open series.

That would give a much clearer picture. March 13, at 9: Thanks for the feedback. Currently the PCR is being calculated using the current series data only. Since the OI for other series is so singapore dollar rate in indian rupees today, it will have very little impact on the PCR value.

March 14, at 4: The data for current series becomes less reliable near expiry and many traders shift to next series. Kindly see if you can add all the open series data. March 14, at 8: For that reason, we do have next month OI and PCR data available here: March 23, at 6: April 29, at Fortunate me I discovered your site accidentally, and I am stunned why this accident did not came about day trading margin futures May 4, at 3: November 24, at 1: Hi, I had a request to enhance the content of this site.

Can we have OI of NIFTY futures on time basis for intraday? This will be very much useful for intraday users. I appreciate your efforts providing the content for free of cost. ACC Adani Ports Ambuja Cem.

Asian Dissertation topics on stock market Aurobindo Pharma Axis Bank B H E L B P C L Bajaj Auto Bank of Baroda Bharti Airtel Bharti Infra. Bosch Trend software for forex Coal India Dr Reddy's Labs Jb hi fi dividend yield Motors GAIL India Grasim Inds H D F C HCL Technologies HDFC Bank Hero Motocorp Hind.

ICICI Commodity futures trading act 1974 Idea Nifty open interest chart live IndusInd Bank Infosys ITC Kotak Mah. St Bk of India Sun Pharma.

NSE - National Stock Exchange of India Ltd.

Tata Motors Tata Motors-DVR Tata Power Co. Tata Steel TCS Tech Mahindra UltraTech Cement Ltd Wipro Yes Bank Zee Entertainment. Nifty OI Nifty Open Interest Tracker Nifty Option Chain: Change in Open Interest Nifty Put Call Ratio: Intraday Nifty PCR Nifty Option Chain Analysis — Traded Volume Put Call Ratio — Day Trend Option Strategy Nifty Option Strategy Diagram Live Max Pain Chart for Derivative Stocks Option Strategies to Mint Money Nifty Option OI Trend — Intraday Nifty Option OI Trend — Daily Nifty Option Price Trend — Intraday Nifty Option Price Trend — Daily BankNifty OI BankNifty Open Interest Chart Bank Nifty Live OI Change BankNifty PCR Trend — Intraday SGX SGX Nifty Live SGX Nifty Table Tools FII activity in cash, futures and options Fibonacci Calculator Advanced Fibonacci Calculator Black Scholes Calculator: Option Pricing Calculator Stocks Stock Bytes Stock Options Chart Stock Options Chain Live Charts Pivot Calculator Developing Pivots Volume Shockers Intraday Breakouts Bulk Deals Data Gap Ups, Gap Downs Profitability Jump Broker Directory Compare Brokers Improve your Skill Pivot Trading Candlestick Patterns Terms Resources Banks IFSC Code Search Banks Fixed Deposit Rates NSE FnO Lot Size FII DII Activity for whole month daily summary of stock market Trading Holidays BSE NSE Trading Holidays Commodity Trading Holidays Stock Brokers in India Beta Version Opening Price Clues USD INR Options Live USD INR: Change in Open Interest Live Stock Screener COUPONS SnP Option Chain: Live Open Interest Nasdaq Option Chain: Nifty Trader's Resources Find Yourself and Trade that way!

Stock Analysis Nifty PCR Screener SGX Nifty FII DII Option Chain Options Max Pain Broker Directory. Please Enter Confirm Password Password does not match.

Back To Email ID. Login To Niftytrader Please Enter Email ID Please Enter Correct Email ID. Forgot Password Please Enter Email ID Please Enter Correct Email ID. Not a member yet? Join Now — it's fun and easy! Please Enter Your Name Please Enter Correct Name.

Nifty Live Open Interest - dakoxok.web.fc2.com

Please Enter Your Email ID Please Enter Correct Email ID. Please Enter Your Mobile Number Please Enter Correct Mobile Number. Can't read the image? Live Nifty Open Interest Chart Nifty LTP OI Support OI Pivot OI Resistance How to take position by OI PIVOT LEVELS and how its calculate.

Dear Amit shah, It is advisable to not take position based on single indicator. For some reason, it seems it is calculating the inverse of PCR. Hopefully it will be rectified soon. Till settlement date in august your put value will decrease. Hi Chintan, Trading is a zero sum game.

Hi Pradeep, Thanks for your prompt response. Can anyone explain how the OI pivot, resistance and support calculated? Options Trading FII DII Activity for whole month Pivot Calculator Black Scholes Option Pricing Calculator.

NSE Stocks and Indices Gap Ups, Gap Downs Stock Options Chain: Recent Comments RAJ KUMAR SAHANI on Intraday Bytes: NSE Stocks and Indices Vasantrao Pawar on JUST NIFTY BLOG ravi thakkar on Put Call Ratio — Day Trend PANDIAN on Intraday Bytes: NSE Stocks and Indices Prakash rao on Intraday Bytes: NSE Stocks and Indices.

Reuters India allows banks, post offices to deposit old bank notes with RBI Sensex edges lower; investors eye RBI minutes Uber co-founder Kalanick resigns as chief executive Global Markets: Oil slump spooks investors; China stocks get MSCI nod Interview: Live Open Interest Charts Nifty Option Chain: Live Nifty Open Interest Chart Nifty Option Chain: Change in Open Interest Nifty Options Traded Volume Bank Nifty Open Interest Bank Nifty Live OI Change Bank Nifty PCR Trend — Intraday Nifty Put Call Ratio: Intraday Nifty PCR Nifty Put Call Ratio — EOD.

Open Interest Trend Analysis Nifty Option OI Trend — Daily Nifty Option OI Trend — Intraday Nifty Option Price Trend — Daily Nifty Option Price Trend — Intraday.

Broker Directory Opening Price Clues Stock Screener Stock Options Chart. Indication of new money coming and indicates further continuance of uptrend. Increase in price is due to short covering of positions. Decrease in price is due to newly build short positions and further weakness is predicted. Traders unwinding their long positions by selling existing contracts.